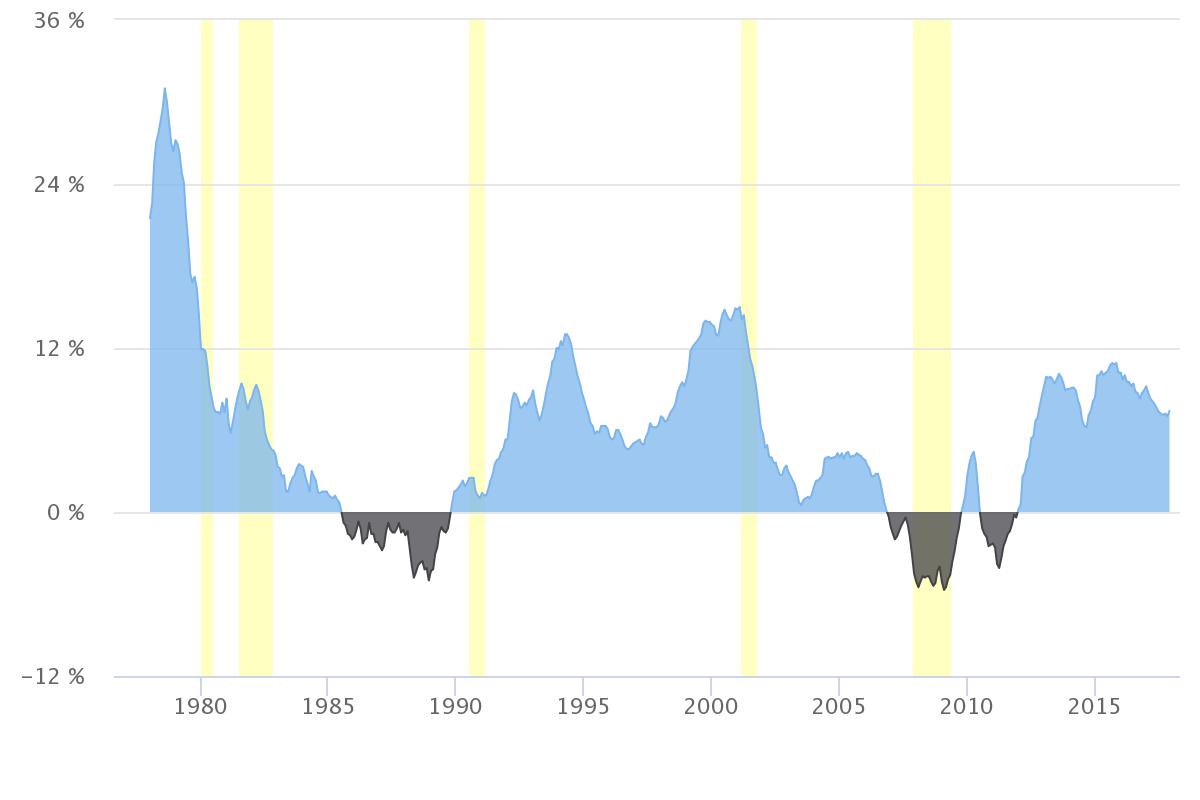

It seems the days of nation-leading home price growth in the Denver metro are gone, at least for now. New numbers from the S&P Case-Shiller Home Price Index show home values grew 7.4 percent to end 2017. The peak for the year was back where it started in January — 9.2 percent — and the rate has been falling since.

Cities like Seattle, Las Vegas, and San Francisco still post double-digit increases. It wasn’t long ago that Denver was at the top of the list too. But back in 2015 and 2016, Denver was still undervalued.

“There was room for double digit price increases,” says Anthony Rael, an agent with RE/MAX “But now that the average and median price points are pushing high $400’s, moving into half a million dollars, that percentage has to just naturally be lower.”

Basically, 7.4 percent of half a million dollars is a substantial gain in equity for homeowners, and Rael says that’s probably still unsustainably high.

While price growth has slowed, it was still enough to rank Denver 5th in the nation, outpacing national values which rose at 6.3 percent. If you look at the long-term, the numbers are even more gaudy. Since 2012, prices are up 38 percent nationally, and 65 percent in Denver.

David M. Blitzer, with S&P Dow Jones Indices, says the price climb “should be causing the same nervous wonder” that the stock market’s recently volatility caused. “None of the cities covered in this release saw real, inflation-adjusted prices fall in 2017.”

Blitzer warns there are some signs that price gains may level off: home sales nationally are flat, and if mortgage interest rates continue to rise it will dampen demand.

Of course, agents always say all real estate is local, and Denver is unique. The same pressures that have defined the market since the Great Recession are expected to continue: a strong job and wage increases, population growth coupled with a lack of supply of new “for sale” homes will continue to push prices upward.