President Joe Biden announced Wednesday he will forgive hundreds of billions of student debt for millions of people, fulfilling a campaign promise — and fueling debates on the Colorado campaign trail.

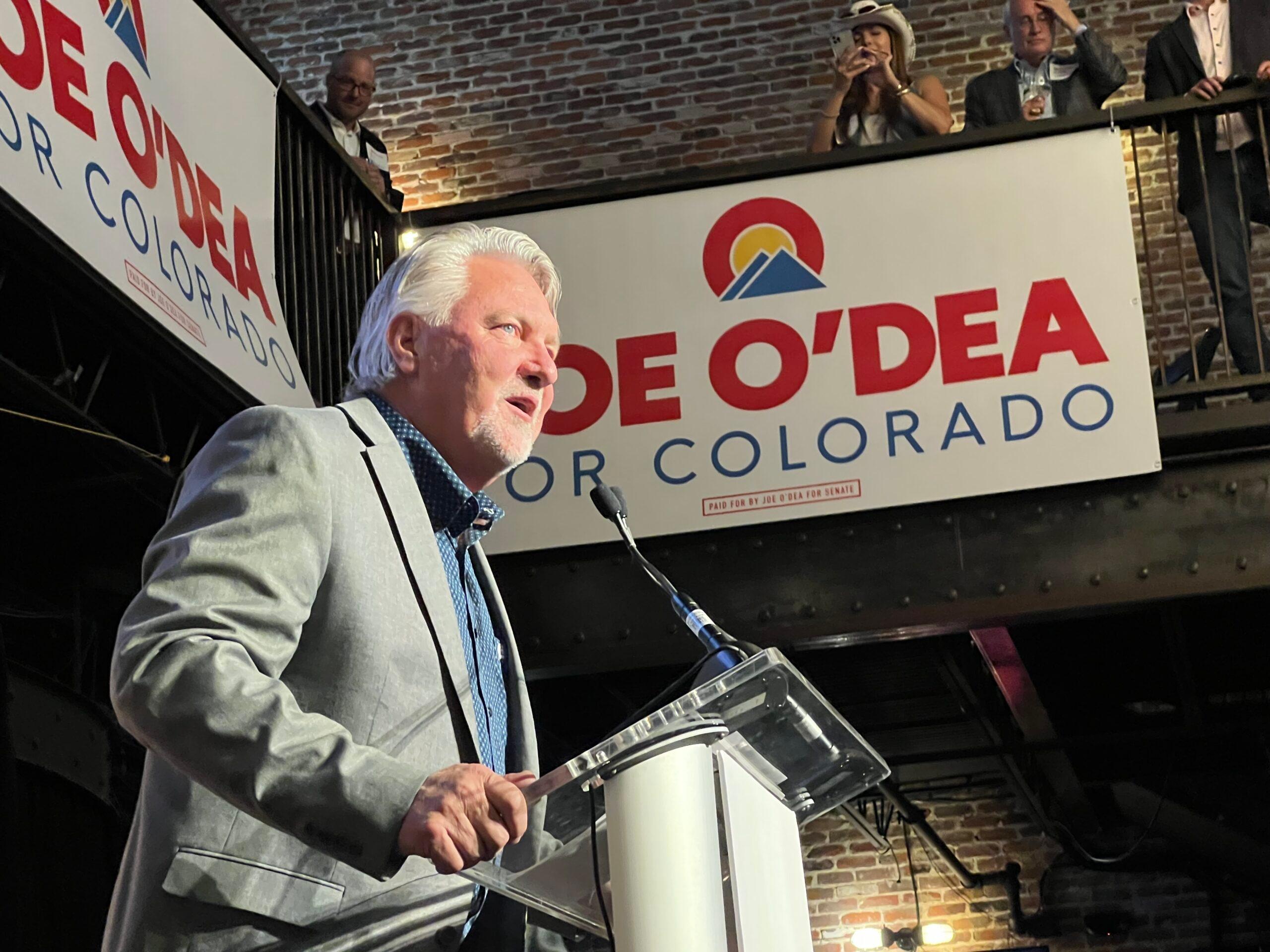

Joe O’Dea, the Republican Senate candidate, harshly criticized the move. “It’s unbelievable. It must be an election year, we must be right in front of the midterms, right?” he told radio host Hugh Hewitt. In a statement, his campaign argued that canceling loans “would penalize” those who already paid.

His opponent, Democratic Sen. Michael Bennet, offered both support and criticism of the plan. In a statement, Bennet said that forgiving some student loans is the right move, but he said that the change should have been more “targeted” to lower incomes, and that it should have included measures to offset its impact on the federal budget.

The Biden plan includes $10,000 of debt forgiveness for individuals making less than $125,000 a year or families earning less than $250,000. Those who received Pell grants — a group that comes from lower-income families — will be eligible for another $10,000 of forgiveness.

Additionally, all borrowers will be allowed to cap their undergraduate debt payments at 5 percent of their income, and the current freeze on student loan repayment obligations will continue through Dec. 31.

O’Dea focused his criticism on the idea that student debt forgiveness would benefit wealthier people at the cost of others. “This is a desperate ploy to transfer debt to working Americans,” he said.

He called it a “gift to rich Americans,” claiming that the “richest 40 percent were responsible for 60 percent of that debt.”

That claim does not accurately describe the effects of Biden’s action.

It’s true that the top 40 percent of earners make up 56 percent of all outstanding student debt, according to a 2019 analysis by the Brookings Institute. That’s what O’Dea was referring to, per his campaign.

But Biden’s plan doesn’t affect “all outstanding student debt” — it only applies to those making less than $125,000. The Biden administration has said that the vast majority of benefits will go to the bottom half of the income spectrum.

As a result of the cap on forgiveness, the benefit for the top 40 percent of the country’s income earners from the main part of the plan will actually be nearly in line with their share of the population, according to one analysis from the Wharton School of the University of Pennsylvania.

And that analysis doesn’t include the effects of the extra $10,000 of forgiveness for Pell grant recipients, which should further boost the benefits for lower-income groups. Deeper analysis of Biden’s plan wasn’t immediately available, since the details have yet to be officially unveiled.

Still, O’Dea is correct that student debt forgiveness will tend to offer fewer benefits to the poorest Americans. The bottom 20 percent of income earners make up just 5 percent of outstanding debt. And O’Dea’s campaign also pointed out that the benefits further stack up for higher earners, since they tend to make larger monthly payments on their debt.

O’Dea also said the change “basically” wipes out all of the deficit reduction that is expected to come from the Democrats’ Inflation Reduction Act.

The climate and tax package was projected to shrink the government deficit by about $300 billion over a decade by bringing in more tax revenues. Meanwhile, Biden’s move is expected to forgive about $300 billion of debt or more — giving up future revenue to the government.

However, the government was not expected to collect that entire sum from borrowers, since many people don’t fully pay off their loans, so it’s hard to say exactly how much Biden’s actions will affect future budgets.

Bennet made similar criticisms, in some ways, of the plan. He also argued that the forgiveness would give too much benefit to higher income people. And he believes it should have been revenue neutral.

“In my view, the administration should have further targeted the relief, and proposed a way to pay for this plan. While immediate relief to families is important, one-time debt cancellation does not solve the underlying problem,” he said.

But Bennet agrees with the concept of forgiving student loans, describing them as a disproportionate burden on people of color. And he praised other elements of the plan, including changes to repayment rules and the Public Service Loan Forgiveness program.

Bennet argues that, done right, student debt forgiveness will boost the working class and people of color. But he has also called for broader reforms.

"Americans deserve more than just student debt relief. An across-the-board cancellation of college debt does nothing to address the absurd cost of college or fix our broken student loan program. It offers nothing to Americans who paid off their college debts, or those who chose a lower priced college to go to as a way of avoiding going into debt or taking on debt,” he said in June. “[R]eally importantly, it ignores the majority of Americans who never went to college, some of whom have debts that are just as staggering and just as unfair.”

House candidates also divided

In the Congressional race in Colorado’s closely divided CO-8, Republican candidate Barbara Kirkmeyer torched Biden's plan.

“Joe Biden’s student loan forgiveness plan will throw fuel on the inflation fire and pile hundreds of billions onto our national debt. But perhaps even more importantly, it is fundamentally unfair to the millions of Americans who worked hard to pay off their loans or the millions of other Americans who chose not to go to college,” said Kirkmeyer, a state senator, in an emailed statement.

A representative for her opponent, Democratic state Rep. Yadira Caraveo, didn’t immediately provide comment.

In CO-7, another closely contested district, Republican candidate Erik Aadland took a similar message, calling the debt forgiveness a handout.

“Such programs discourage individuals from making sound financial decisions and do nothing to address making education more affordable,” he said in a written statement.

“The U.S. has a low unemployment rate and college graduates are among the highest paid citizens in the country. The least anyone should do is pay as they agreed, rather than placing this burden on others.”

The Democrat in the CO-7 race, state Sen. Brittany Pettersen, had a generally supportive take on Biden’s plan.

“I put myself through school waiting tables and became the first in my family to graduate from college. With the skyrocketing cost of higher education, this would be impossible today. I'm grateful to President Joe Biden for taking this critical first step as we continue to address surging tuition costs, but we have a lot more work to do,” Pettersen said in a statement.