Colorado is in a position to at least partially offset the most significant changes to health care and insurance under the tax overhaul packages now making their way through Congress. That's according to Larry Levitt, senior vice president at the Kaiser Family Foundation and health policy expert.

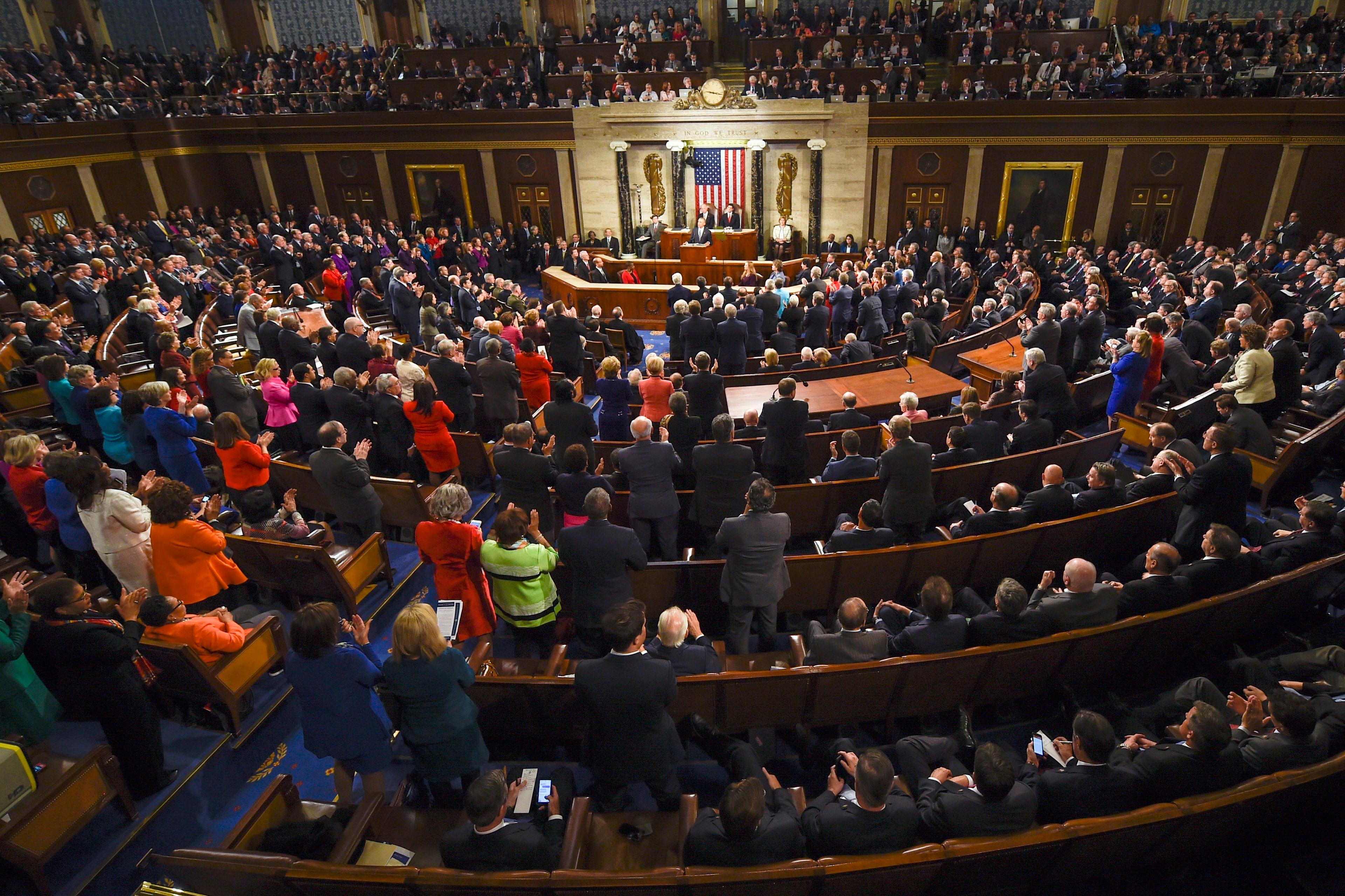

The Senate version includes a repeal of the penalty people have to pay if they don't have health insurance, and Congressional leaders in both chambers say it's likely that provision will make it into the final bill. It is a key part of the Affordable Care Act, meant to increase the pool of people buying health coverage, so it's not just sick people. Taking away the penalty would essentially end the mandate to buy health insurance, which Levitt says is projected to increase premiums for people who continue to buy insurance, and increase the number of uninsured people.

Specifically, the Congressional Budget Office estimates 13 million more people nationwide would be uninsured by 2027, and premiums for people who buy insurance on their own would go up about 10 percent.

Levitt tells Colorado Matters the state could do two things to keep people insured. One would be consumer outreach, to make more people aware of the subsidies that are often available to help them buy healthcare. Also, the state could impose its own mandate to have health insurance.

"Massachusetts had an individual mandate even before the Affordable Care Act passed. Washington, D.C., which operates its own exchange [like Colorado] has been talking about imposing its own individual mandate penalty," Levitt says.

As part of the tax plan negotiations in the Senate, that chamber's leadership agreed to discuss two other bills that are meant to shore up health insurance markets and, to some extent, blunt the impact of eliminating the national mandate to buy health insurance. Gov. John Hickenlooper and others have lobbied extensively for measures like this to stabilize the markets. However, their future in the tax plan reconciliation is in doubt.

There are other health care-related provisions in the tax plans, including one for catastrophic medical bills. Right now, people who itemize their taxes can deduct medical bills that are at least 10 percent of their income. Levitt says this credit is particularly important for elderly people, a population that's growing quickly in Colorado. The House bill eliminates the tax credit, while the Senate bill expands it.