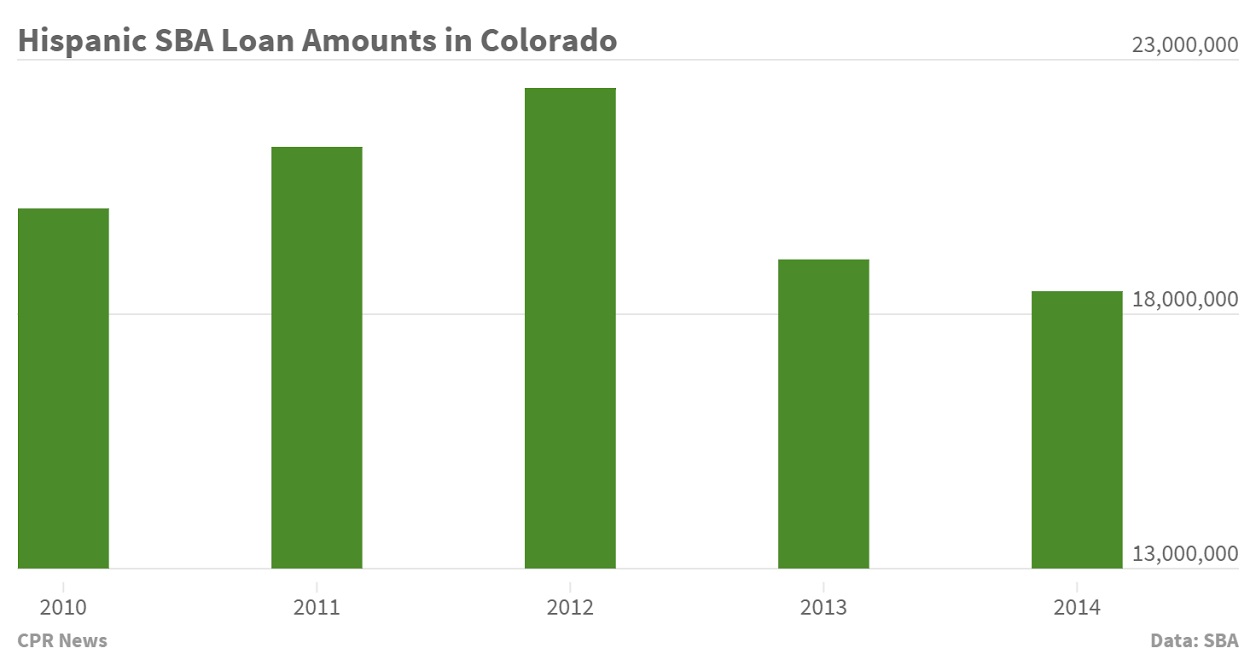

Hispanics are the dominant minority group in Colorado, but when it comes to small business loans, they are falling significantly behind. In fact, Hispanic-owned businesses are the only group borrowing less money today than they did five years ago.

To understand two of the big reasons why, let’s meet Marjorie Silva. Back when she was still living in central Peru, someone told Silva the cake at her son’s birthday party was so good that she should sell them. Eventually she was running a small cash-only business out of her kitchen.

"I did a little sign, with wood, painted it very pretty, and put it above the door of my house," said Silva. "And I was actually pretty busy, I was doing everybody’s cakes in town."

She immigrated to Colorado about 15 years ago, and after working in someone else’s bakery for a while, she was ready to start out on her own again. That’s when she ran into two of the biggest obstacles facing Hispanics looking for a business loan: a lack of collateral and a good credit rating.

"I wasn’t bankable at all, I didn’t have no assets. I didn’t own a house. We had a car, but we were still paying on it," said Silva. "We didn’t got nothing to show for a normal loan that that’s pretty much what they look at, you know, ‘OK, what are your assets?’"

For many Hispanics this was exacerbated by the great recession. One study by the Urban Institute found Hispanics lost far more wealth than whites or blacks during the Great Recession.

"We saw, during that period, a ton of people losing homes, businesses, cars," said Elena Vasconez, with Mi Casa Resource Center, which helps counsel aspiring business owners. "They ended up living with relatives and friends for awhile. And even now we see a few that are still struggling."

Vasconez said many Hispanics felt their community was specifically targeted by predatory lenders, and she said a number of Hispanic businesses are now shunning the financial system altogether.

"I don’t think the community has really healed from that," said Vasconez. "It’s still affecting a lot of families."

This distrust builds on a cultural aversion to banks in the first place, according to Ed Cadena. He remembers his father’s cash-only barber shop in Las Cruces, New Mexico.

"He made a lot of sense: ‘If you owe nobody anything, then nobody owns you.’"

Cadena is now the Colorado district director for the Small Business Administration. He said Hispanic culture manifests itself in other ways too, in a reluctance to ask for help, and that includes help from banks or institutions.

"They always say that Latinos, they’re macho, they don’t want to ask for the help," said Cadena. "I think that’s part of the culture, that they don’t want to look like they don’t know."

He said when it comes to loans, language is also a barrier for some, particularly when it comes to writing a business plan. He said others may be afraid of coming to the SBA for help if a family member is in the country illegally.

Surprisingly, he said another thing keeping Hispanics from forming new businesses and getting loans is, actually, the booming Colorado economy.

"One thing that Latinos, especially new immigrants, are being able to do is they’re being able to walk onto a site, saying, ‘I’m an electrician, I’m a plumber,’ they got more work than they even know what to do with at this point," Cadena said.

Nevertheless, he said many Hispanic entrepreneurs are missing out on a chance to grow their business. And he concedes there should be more outreach.

"We try. We should be going out there. I’ll never make an excuse," Cadena said, adding that microloans are a great way for Hispanics to enter the banking system and he’s trying to recruit more microlenders to work with the SBA. They don’t require the same stringent collateral and credit history of a traditional loan.

This is where our story returns to baker Marjorie Silva. After taking classes on how to write a business plan she qualified for a microloan of about $50,000.

"I’m impressed that I was able to do all that much with $50,000," said Silva.

She recently graduated from this microloan to a larger loan from a traditional bank That helped her move from her small bakery in Englewood to a bigger location in Denver, along busy South Broadway.

"This is the American dream, and I’m still dreaming. Hopefully someday I’ll be rich," said Silva.