Oil prices surpassed $70 dollars a barrel in May, reaching the highest price point in more than three years. Colorado drillers are not missing the opportunity to cash in.

The government’s Energy Information Administration predicts companies will pump a record 595,635 barrels of oil a day from the Niobrara formation in June, most of the activity in the Niobrara is centered in Weld County.

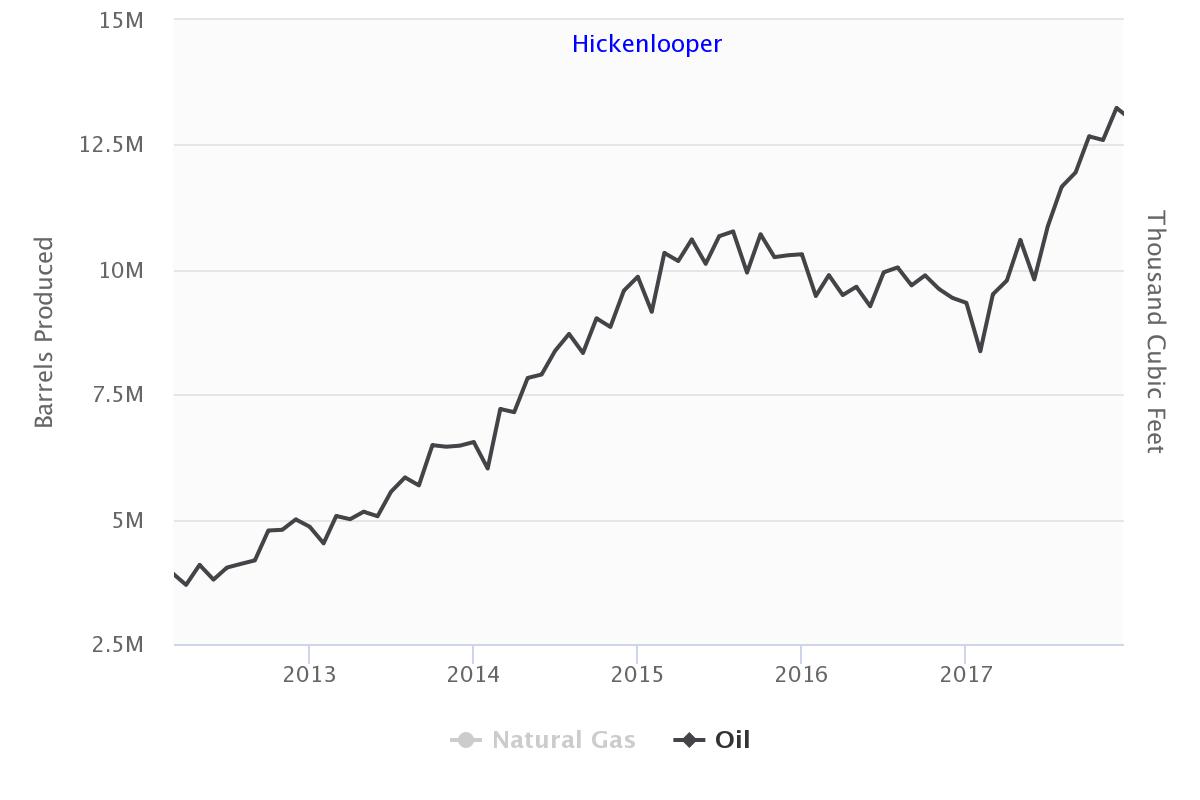

Colorado production numbers are delayed a few months, but they show operators producing more than 13 million barrels a month in December and January. That’s a level of production never seen before in the state.

Higher prices and production are helping oil companies turn a corner on what was a prolonged and dismal downturn. Anadarko Petroleum, the state’s largest driller, posted a profit in first quarter of 2018 of $121 million. Noble Energy, the second largest driller, banked $554 million.

Anadarko’s financial reports noted that it achieved record sales volumes in Colorado, averaging more than 260,000 barrels a day — an 8 percent increase.

Operators continue to do more with less. The total number of active rigs in Colorado was 30, a fraction of the amount from the last boom, according to data from Baker Hughes. Experts say that’s because operators have become more efficient, and can move rigs to another site quickly. Drillers are also finishing wells that were previously drilled, but not completed. The EIA reports the number of those wells in the Niobrara fell to their lowest point since 2014.

There are significant risks to the current oil boom though. Demand for oil is expected to fall, likely because of rising prices, says the International Energy Agency. In parallel, Gasoline prices have risen alongside oil, up to almost $3 a gallon, the highest in more than three years. Also, it’s not yet clear how geopolitical risks, like the U.S. pulling out of the Iran nuclear deal will affect markets.