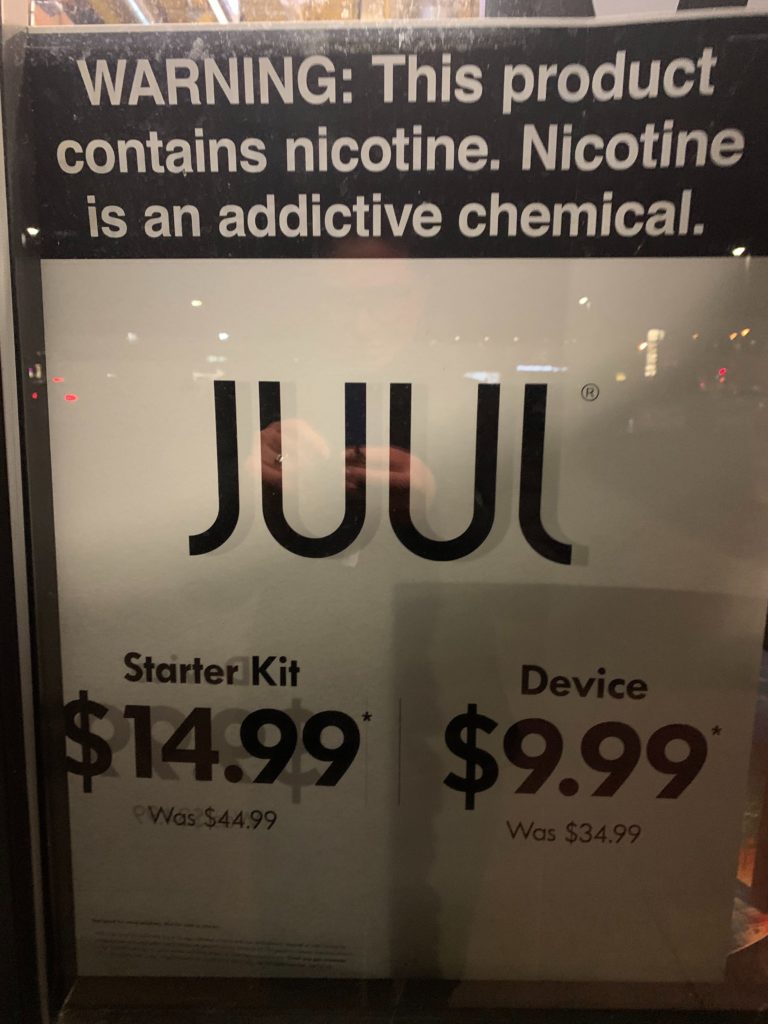

In recent weeks, signs in smoke shops and convenience stores across Colorado have shown dramatic price cuts for JUUL products.

One vape shop in Boulder advertised a JUUL starter kit, with pods and device, on sale for $14.99, a third its original price. A JUUL device on its own was cut from $25 to $9.99. A convenience store in Centennial posted a sign for the same discount on a device.

A federal crackdown means stores have to clear their shelves of pod- and cartridge-based e-cigarettes, except for tobacco and menthol-flavored products, by Feb. 6, 2020.

“Wholesalers and distributors are not required by the FDA to take them back so people are trying to not have dead inventory and tied-up dead operating expenses,” said Grier Bailey, executive director of the Colorado Wyoming Petroleum Marketers Association, which represents most of the state’s roughly 2,000 convenience stores.

It’s a sign of the forces turning against the e-cigarette giant. Over a decade-spanning both Democratic and Republican administrations, the devices were mostly unregulated even as teen vaping rates shot upward unabated. But increasingly, health concerns have generated headlines, especially after youth use shot up dramatically and people started getting sick last year with vaping-related illnesses.

In Colorado, state and local governments have targeted e-cigarettes for additional rules and regulations. The federal government has stepped up scrutiny, too. JUUL, along with other e-cigarette manufacturers, is at a critical crossroads as it navigates turbulent financial waters and growing scrutiny from public officials and the courts.

That pressure will get a public airing on Wednesday when U.S. executives of the top five manufacturers of e-cigarettes are set to testify before House lawmakers on Capitol Hill about their role in the epidemic.

Leaders from JUUL, Logic, NJOY, Fontem (blu) and Reynolds American, Inc. are scheduled to appear before the House Energy and Commerce Oversight and Investigation Subcommittee. The five represent nearly the entire e-cigarette market, according to the office of Democratic Rep. Diana DeGette, the committee chair.

“Nobody using these vaping products really knows how they will affect their health,” DeGette said. “Yet, while consumers remain in the dark of the possible health consequences, these companies are making billions of dollars as they lure a new generation of young people into a lifetime of nicotine addiction.”

The Congress member said she’s alarmed about the epidemic of teen vaping and wants answers from the companies.

“They need to tell me and the rest of Congress how they're going to participate with truly trying to get rid of the teen vaping epidemic," DeGette said.

JUUL didn’t respond to an interview request for this story. In December, JUUL spokesman Ted Kwong said the company was focused on "earning the trust of society" and is taking steps to combat underage use.

“Our customer base is the world’s one billion adult smokers and we do not intend to attract underage users," Kwong said.

Gregory Conley, head of pro-vaping advocacy organization American Vaping Association, sharply criticized the hearing.

“This is a sham hearing so that (committee) members have an opportunity to conduct some photo ops yelling at companies that they dislike,” Conley said.

He said since only the top manufacturers would be represented, lawmakers would not hear anything from another part of the industry, which makes and sells open, refillable systems, as opposed to closed system cartridges and pods like JUUL does.

“It would have actually given that side of the industry an opportunity to explain why their products are important,” Conley said. “But the majority Democrats on that committee don't really want to have a back and forth."

Although the committee is bipartisan and both sides will have the opportunity to ask questions, Conley thinks the purpose of the hearing is to lay the groundwork for Democratic legislation to ban the sale of flavored tobacco and take away authority from the FDA to decide which products “could actually benefit public health” if they are flavored.

“So there's a big difference between concern and a political stunt designed to lay the groundwork for a bill that would destroy the vaping products industry,” Conley said.

The hearing comes as a growing number of lawsuits are piling up against JUUL.

For public health advocates and local governments, Wednesday’s hearing is a chance to get some answers about whether e-cigarette companies did in fact target teens.

Just last week, the city of Denver became the fourth Colorado government to join litigation against the company. The number of lawsuits in the U.S. against JUUL is now more than 300, according to Neil Makhija, a lecturer at the University of Pennsylvania Carey Law School who has represented families in a class-action suit alleging JUUL marketed to minors.

Colorado Attorney General Phil Weiser is investigating the company’s marketing practices. State lawmakers last session added e-cigarettes to a prohibition on conventional smoking in most indoor public places. And they passed a law ensuring local governments would no longer be penalized by losing tax money for cracking down on tobacco use, opening the door for a wave of new restrictions.

Colorado has the nation's highest teen vaping rates: A quarter of high schoolers currently used an electronic product, double the national average, according to a 2018 survey. In Denver, one in five teens uses e-cigarettes, and only half of Colorado teens think vaping is risky, according to Denver Public Health.

At a press conference Monday with DeGette, teenagers said vaping was rampant at school. Some said they thought official surveys underestimated the number of teens vaping. “From what I've seen in the classroom, out of the classroom, really, wherever, it's almost like three of five students, maybe higher,” said Aden Ray, a junior at South. “I don't think it's represented fairly how it actually is.”

Lawmakers can draw on the information popping up in lawsuits and news reports for their questioning on Wednesday. Reuters reported in November that JUUL disregarded early evidence its product was proving highly addictive to teens. According to papers filed in court, JUUL Labs' leaders carefully studied how big tobacco used sophisticated marketing practices to entice teens to smoke, and then employed the same strategy.

“I'll be watching,” Denver City Attorney Kristin Bronson said.

She thinks the testimony from JUUL executives could be relevant to Denver’s case.

“I mean, it's testimony under oath," Bronson said. "So they are expected and should be telling the truth and fully disclosing and being transparent about what they knew and about their marketing campaigns and about the amount of money they've made from targeting our youth.”

Makhija said the scale of the hearing was significant, too.

“Tomorrow's hearing is going to be more expansive in that they're bringing in the whole industry,” Makhija said.

He wondered if committee members would probe the companies about flavors and sales to children. Makhija hoped direct questions would help “get at the truth in terms of how this epidemic was created and, and who should be held responsible.”

JUUL and its supporters have consistently said its products are aimed at helping adult users stop smoking conventional cigarettes. But the legal action contends JUUL developed a sophisticated ad campaign that used social media “influencers” to hook teens.

The litigation argues JUUL held at least “50 highly stylized” parties in cities around the U.S. starting in 2015. They paid “social media influencers” to post to photos of themselves with JUUL devices using its hashtags, according to the complaint. The company also hired an ad agency “to identify and recruit social media influencers” that had at least 30,000 followers, according to an internal JUUL email.

That enabled JUUL to “establish a network of creatives to leverage as loyalists” for the brand, according to the court filings. JUUL paid one influencer $1,000 for just one blog post and one Instagram post in 2017, according to the suit. And “thousands of young people” were given free “JUUL starter kits.”

JUUL posted photos of young people “enthusiastically puffing” on the company's e-cigarettes across their social media channels, most prominently on Instagram. One high profile example of the product’s broad reach with influential figures, according to the complaint: Pop star Katy Perry held a JUUL at the Golden Globe awards.

The litigation concludes JUUL “knew these images would be successful” in luring teens to use its products because it deliberately modeled them to mirror specific traditional tobacco advertisements that Big Tobacco had used to target young adults.

“In fact, many of JUUL’s ads are nearly identical to old cigarette ads that were designed to get teens to smoke,” the complaint states.

“I think that JUUL is going to end up having a problem with their marketing tactics (in the court cases),” said Sommer Luther, a Denver attorney who specializes in personal injury and medical malpractice cases. Luther is not involved in the litigation but is following it.

She said claims made by the company’s “really aggressive marketing” could be exposed as downplaying the health risks or worse, especially once more information comes out through depositions and even Congressional testimony.

Luther said she sees parallels between the way health concerns, and later government action, are playing out for vaping as they did for opioids and conventional cigarettes.

“The similarity is amazing," Luther said. “But we know a lot more now.”

Jeanne McQueeney, a county commissioner in Eagle County, one of the four Colorado governments to join litigation against JUUL, said she hoped attention to teen vaping from federal officials would complement local efforts.

“We're hoping that maybe the federal government will see through this new testimony that there's reasons for the federal government to impose some rules," McQueeney said.

Lawmakers are expected to press e-cigarette executives on the safety of their products.

JUUL executives testified before Congress last year in a hearing that included public health advocates and academics who’ve studied e-cigarettes. The hearings signaled increased federal scrutiny.

The Food and Drug Administration has declared that no vaping products, what it calls electronic nicotine delivery systems, in the U.S. are on the market legally. A federal judge has ordered companies must file applications to the FDA for approval by May. To be legally marketed as a tobacco product, it would need to “undergo FDA scientific review” and the agency would have to find its marketing appropriate for the protection of the public health.

The once-ascendant company has seen the financial effects of that swing in public opinion and federal attention. Tobacco giant Altria bought a 35% stake in JUUL in 2018. But at the end of last month, it revealed it was slashing its valuation of JUUL Labs, for a second time, downward by $4 billion to $12 billion. Forbes reported Altria made the move “citing an increased number of legal cases pending against JUUL — with no end in sight.”

“That is an insane drop in valuation,” said Chris Hughen, associate professor of finance at the University of Denver.

He said with JUUL’s sales soaring at the time, Altria wanted to invest in the young company, but made an enormous mistake by miscalculating their investment.

“I think that there are a number of risks that Altria just didn't fairly assess when they were making this investment," Hughen said.

Over the last several months, JUUL has tried to change course. In September, it replaced its CEO with a top Altria official. It changed some top executives in October. In November, it announced it was laying off 650 people, 16 percent of its global workforce, and cutting spending by $1 billion. Many of the cuts came in the marketing department, as JUUL underwent what its CEO called a “reset.”

Hughen said he thought JUUL would ultimately make it through its current troubles.

“It's all survivable,” Hughen said. ”But in the end, when you have someone who owns 35 percent of your company that has incredible financial resources, it's unlikely to go under. The problem with Altria is they're getting dragged into some of these lawsuits.”