Updated 12:51 p.m.

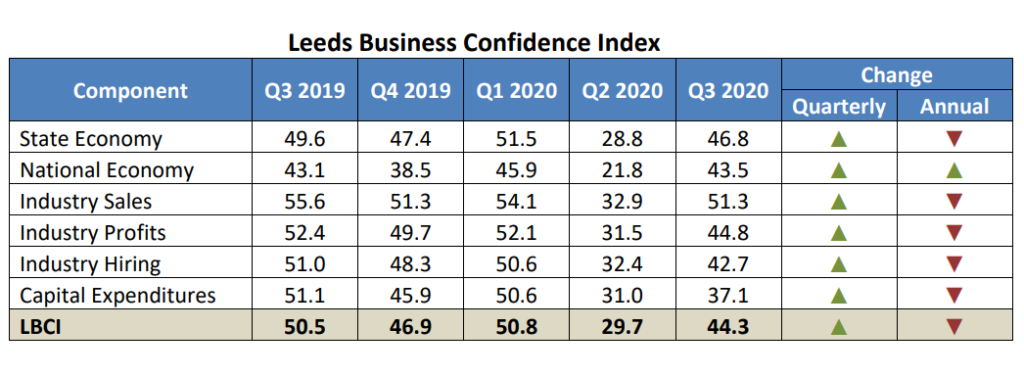

Colorado business leaders’ optimism is rebounding, but the COVID-19 pandemic remains a drag on hiring and capital spending, according to a report by researchers at the University of Colorado Leeds School of Business.

Expectations for sales and profits jumped during the third quarter relative to the historic lows in the prior three-month period as business leaders cited pent-up demand and resiliency, according to the report. A majority of company managers anticipate sales and employment reaching pre-pandemic levels during the next 12 months. Still, others don’t expect a recovery until 2022 at the earliest, and a small segment never expects to recover, according to the report.

Roughly half of the respondents expect a decline in business investment, while about 40 percent anticipate a reduction in hiring.

“Business leaders are telling us they are optimistic the COVID-19 economic bounce back will occur fairly rapidly,” Richard Wobbekind, executive director at the Leeds Business Research Division, wrote in the report. “However, the pessimism we are seeing in business spending and hiring is a cause for concern.”

The state’s unemployment rate surged to a record 12.2 percent in April during widespread shutdowns due to the pandemic. It fell to 10.2 percent in May as some businesses began to reopen, according to the Colorado Department of Labor and Employment.

Concern is mounting that states rushed to reopen too soon. That could lead to a second wave of business closures and another blow to the economy. Gov. Jared Polis this week ordered the state’s bars to shut back down amid an uptick in infections. Colorado has so far avoided the major increases in cases that neighboring states have seen.

The survey was conducted from June 1 through June 19th. The report’s authors don’t think the results would be materially different today despite the walk back of reopenings elsewhere in the intervening weeks. Industries such as finance and business services aren’t yet retrenching, and they account for a large portion of respondents, according to Brian Lewandowski, Wobbekind’s counterpart at the Leeds Business Research Division. There could be a change of sentiment for the tourism industry, which includes restaurants and bars, he said.

“Our tourism industry… has been under a lot of pressure from the get-go,” Lewandowski said. “This could renew some pessimism among that cohort.”

Businesses are on the lookout for collateral damage that isn’t yet fully accounted for, according to Wobbekind. For example, workers aren’t returning to the office as quickly as real estate companies had hoped, which will make it more difficult for landlords to fill available space if the trend persists, he said. Also, consumer credit card delinquencies are rising, indicating that households are increasingly struggling to pay their bills, according to Wobbekind.