Colorado voters have apparently decided not to lower property tax rates. By 8:45 p.m., Proposition 120 had the support of only about 43 percent of voters, and backers conceded it looked likely to fail. That figure has stayed steady through the latest counts early Wednesday morning.

Colorado’s property values have soared in recent years, resulting in higher tax bills. Even some opponents of the measure thought that voters would approve the cut as they looked for a break.

“I’m pleasantly surprised. I think folks are onto the games that are being played at the ballot, and I think that folks looked at this and understood something wasn’t right with the measure,” said Scott Wasserman, president of the progressive Bell Policy Center. The cut “would have devastated communities’ revenues … This was like a total blunt instrument.”

However, supporters of the measure are blaming state lawmakers for interfering with the ballot measure.

As written, Proposition 120 would have reduced the amount of property tax collected statewide by an estimated $1 billion. But state lawmakers already have moved to significantly limit the potential results of the ballot measure, potentially cutting the reduction to just $50 million.

A law passed this spring, after the ballot language for Proposition 120 was finalized, would have canceled out large parts of the ballot measure. Under the new law, the potential permanent tax cut from Proposition 120 would only apply to lodging and multifamily housing — and not single-family residences.

That law was passed by Democrats with support from a handful of Republicans from mostly rural areas. Property taxes pay for local services such as schools, county-road maintenance, and fire and library districts, among other things, and a cut could be especially painful for rural areas that have seen less property value growth.

Those changes gutted the proposal and diminished its appeal, since it would no longer apply to residential property, said campaign organizer Michael Fields.

“I think that people didn’t think it was a tax cut for them. They weren’t as interested in cutting taxes for hotels and multi-family,” said Fields, the executive director of the conservative group Colorado Rising Action, which got the measure on the ballot. He noted that the proposal was even losing in conservative Douglas and El Paso counties.

The legislature’s changes weren’t explained on voters’ ballots, but they were detailed in the Blue Book of election information that is mailed to Colorado voters.

“I think there was confusion, also … I ran into a lot of people asking questions and saying, ‘Well, I’m voting no,’” Fields said, adding that the legislature’s intervention “set a bad precedent.”

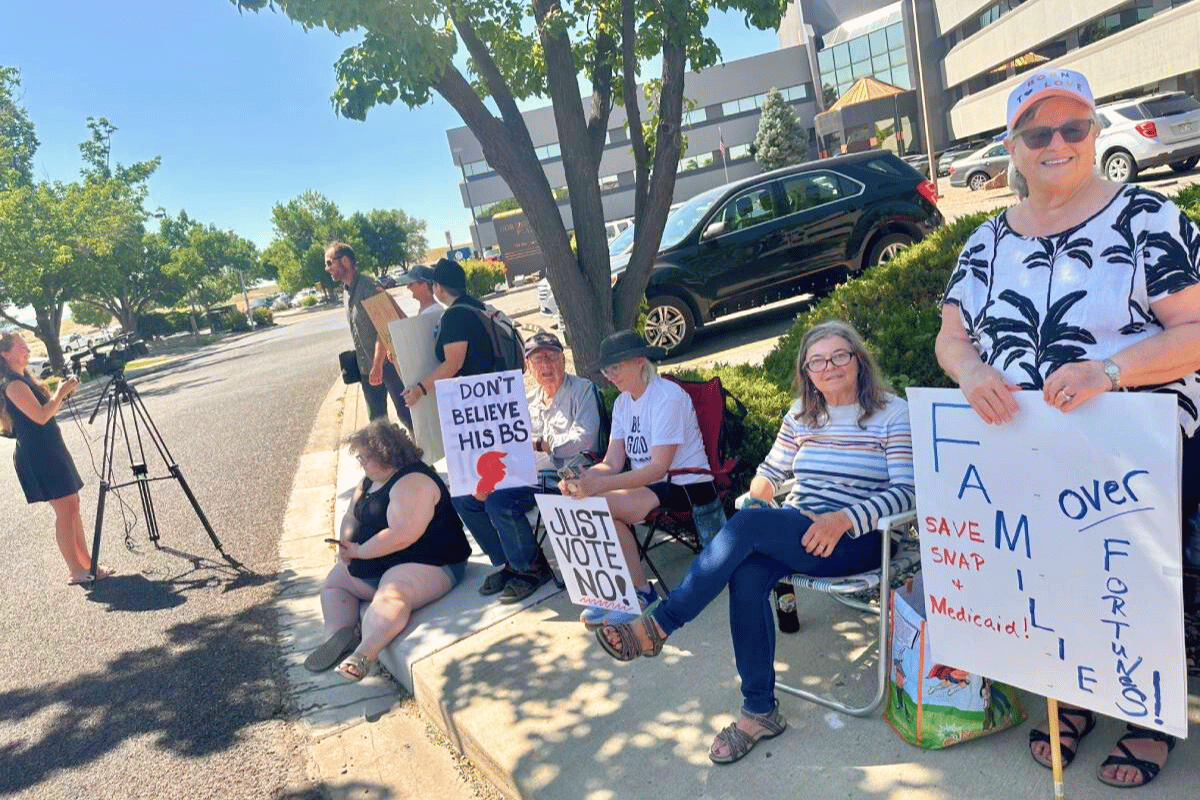

On Election Day, several voters in Lakewood said that the measure was a big draw for them during this relatively sleepy off-year election.

“Everything’s exciting, especially when it hits our pockets — I own a home!” said Nicole Shoemaker, 39, a resident of unincorporated Jefferson County.

The campaign group Cut Property Taxes, which is tied to Colorado Rising, reported spending about $1.5 million to support the tax cut, largely on canvassers and advertisements. The campaign received about $242,000 from the Apartment Association of Metro Denver, with most of the rest coming from the conservative groups Unite For Colorado and Colorado Rising State Action.

There was no organized campaign to stop the proposal, Wasserman said, but local leaders and organizations tried to explain the effects of a potential cut to their constituents. He added that some organizers had grown fatigued

A separate measure sponsored by Colorado Rising Action, Amendment 78, appears to be losing by a similar margin. That proposal would have required the state legislature to directly approve more types of government spending.