A last-minute bill in the state legislature would temporarily lower property tax rates and allow some homeowners to delay part of their property tax payments.

But the bill also has a subtle effect that is infuriating some conservatives: It’s designed to partially cancel out voters’ chance to cut property taxes by a larger amount this November.

How would the change affect your tax bills?

The bill, SB-293, is meant in part to blunt the rapid tax increases that are hitting many homeowners. Extreme demand for housing is leading to higher property values. That means that people will pay higher taxes on their properties.

“We are reacting to this increasing — suddenly and unexpected, to some extent — value of home prices, to try to give homeowners the proper amount of relief,” said Sen. Bob Rankin, a Republican sponsor and member of the Joint Budget Committee.

The bill would temporarily lower property tax rates. The taxes owed for apartment properties would be reduced by about 5 percent. Single family homes would get a discount of about 3 percent. Agricultural and renewable energy properties would get a 9 percent reduction.

Those discounts would only apply for the tax years 2022 and 2023. And many people would still see an increase in their tax bills, compared to right now, since base property values have climbed so sharply.

The bill was introduced in the final weeks of the session, but Sen. Chris Hansen, a Democrat and a member of the JBC, said he and the others have been working on it for several weeks.

“We're really trying to step in and do something proactive on a bipartisan basis,” he said.

The bill would also create a permanent new option to ease the burden of property taxes. When tax values increase too sharply, homeowners would be allowed to delay part of their bills. Up to $10,000 could be deferred until the person sells their home. Analysts think that Colorado homeowners will defer less than $1 million per year in all.

Under the bill, the state would increase its contributions to schools to make up for some of the lost property tax revenue, and it would loan money to local governments to cover the cost of tax deferrals.

In the past, the state’s complex web of fiscal laws would have slowed down the property tax increases caused by a hot market. But voters agreed to repeal the Gallagher Amendment last year, taking away one of the major restraints on property taxes.

How is it affecting the other potential tax cut?

There is a separate effort to cut property taxes. The conservative group Colorado Rising Action has proposed a broader cut to property taxes, known as Proposed Initiative 27. The group won state Supreme Court approval for the language of the initiative on May 27, and supporters are collecting signatures to put the measure on the November ballot. If it makes the ballot and voters approve, it would cut tax rates by 9 percent, costing local districts $1 billion in potential revenue.

But that ballot initiative could be reshaped by the legislature’s actions in the next week. The sponsors have specifically written their bill so that it changes the potential effects of Initiative 27.

The bill would make it so that the approval of Initiative 27 would only lower the property tax rate for lodging and multi-family buildings — instead of lowering taxes across the board. It does that by changing some of the legal language upon which the initiative is built.

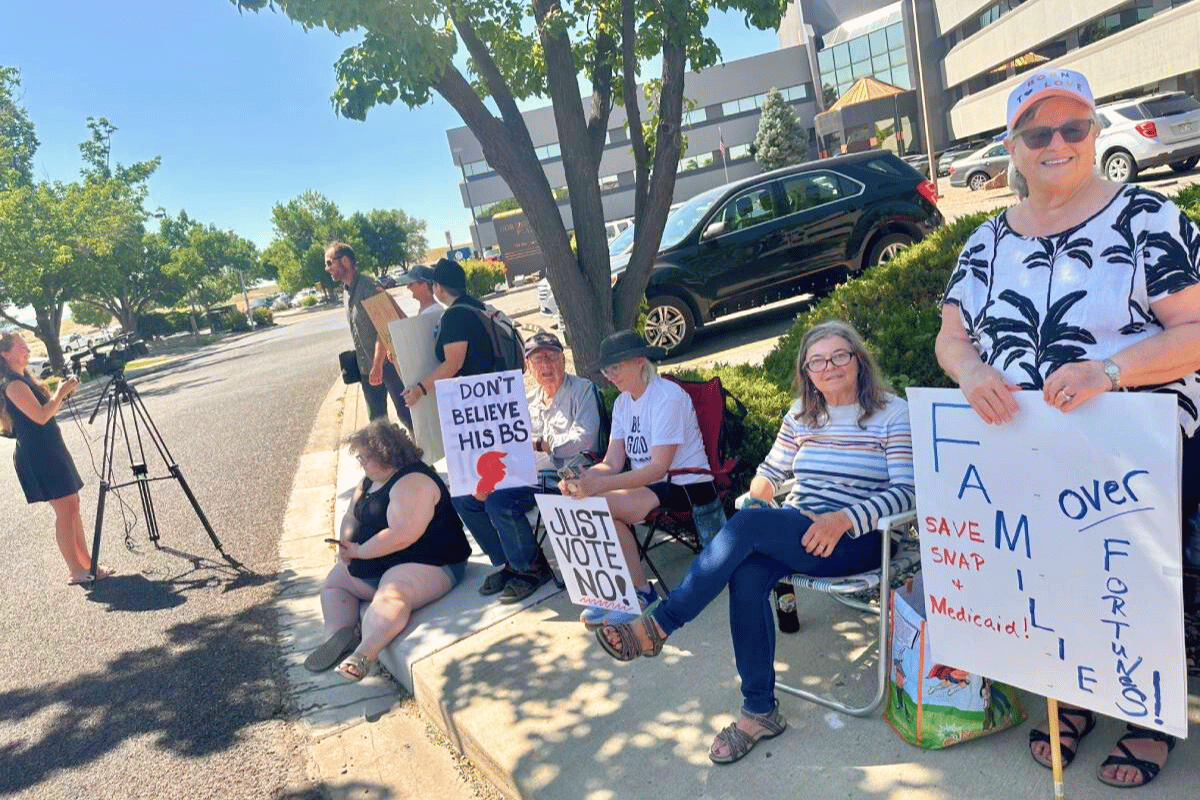

“There’s no doubt that it’s a direct assault, not allowing voters to weigh in on a larger property tax cut,” said Michael Fields, the organizer behind Initiative 27. The lawmakers only introduced the bill after his ballot language was approved. It sets a precedent, Fields argued, that allows lawmakers to simply defuse ballot initiatives by re-engineering the law before they’re passed.

The Colorado GOP similarly argued that it’s an attempted reversal of a ballot initiative that hasn’t happened yet.

“Voters don’t want to be cheated. This won’t end well for the Dems,” read a tweet from the party.

Sens. Rankin and Hansen acknowledged that they were trying to change the effects of the ballot initiative. A 9-percent tax cut would be devastating for rural communities, Rankin said.

Many rural areas have seen very little growth in their property tax revenues — which means they don’t have any cushion to protect them from a tax cut. Instead of just slowing down the growth of property tax bills, a rate cut would actually reduce the funding for rural roads, emergency services and more.

“I believe that (tax-cutting) ballot measure will make it to the ballot, and I actually believe it will pass,” Rankin said.

“I think what we're doing here is trying to make room for that, but we're also trying to say, ‘Here's how it fits with the longer-term strategy of protecting homeowners from a rapid increases’ — but at the same time, making sure that our state agencies and local counties and districts have viable funding,” he said.

Hansen said that there’s already a precedent for this kind of maneuver. He pointed to a law passed by a Republican majority in 2004. That law aimed to respond to potential ballot initiatives, arguing that the direct democracy process could “adversely affect the ability of the General Assembly to develop policies and funding priorities in a comprehensive and balanced manner.”

It shows an uncomfortable truth for some politicians in Colorado: Voters have a lot of direct power, and they often vote for lower taxes. But that can result in cuts to services that voters actually like.

The bipartisan sponsors of the new legislation hope that it’s seen as a compromise that achieves some of the goals of the tax-cut initiative — without hurting local budgets.

Hansen denied that the bill would take away voters’ options, saying it still left open the option to run further measures. He argued that by repealing Gallagher, voters have already signaled that they want lawmakers to stop the rural property-tax base from eroding.

- Colorado Voters Repeal Gallagher Restraint On Residential Property Taxes

- The Year That Democrats Left TABOR Behind: How Billions In New Spending Can Cut Through Colorado’s Conservative Firewall

- Colorado Cities Can Now Require Affordable Housing In New Developments — With A Catch

- Colorado Renters And Landlords Are In A Race With The Eviction Ban. Should The State Intervene?

- You Read Your Mail Right. Property Values Are Up Across Colorado

“The voters spoke very clearly on Gallagher. It was not close. It was an overwhelming support for repeal that sent a strong signal that the voters of this state want sound fiscal management and not having a rapid erosion of property taxes that undercuts local district funding models,” he said. “That's the action that we are taking into account as we move forward with this bill.”

Rankin said that, in the long run, he wanted to move away from part of Colorado’s current approach to property taxes. Property taxes are based on a formula that includes a few major components. Voters in each area can adjust the local component of the tax rate — the number of mills. But another component, the assessment rate, is set for the entire state.

Rankin wants to see regional assessment rates, which would make it harder for a single statewide vote to have such widespread effects. That change would require another constitutional amendment.

CPR public affairs reporter Bente Birkeland contributed to this story.