House Republicans last month passed a tax and spending bill reflecting President Donald Trump’s budget priorities. It’s now being considered in the Senate. GOP congressional leaders want to have a deal before the July 4 recess.

The proposal includes $350 billion in cuts to the student loan system to help offset more than $4 trillion in tax cuts and large boosts to the military and border security. The Congressional Budget Office estimates the House bill would increase federal deficits by $2.4 trillion over 10 years. It also includes a $20 billion school voucher program over four years that would include states like Colorado where voters have previously rejected them.

Here's what's at stake.

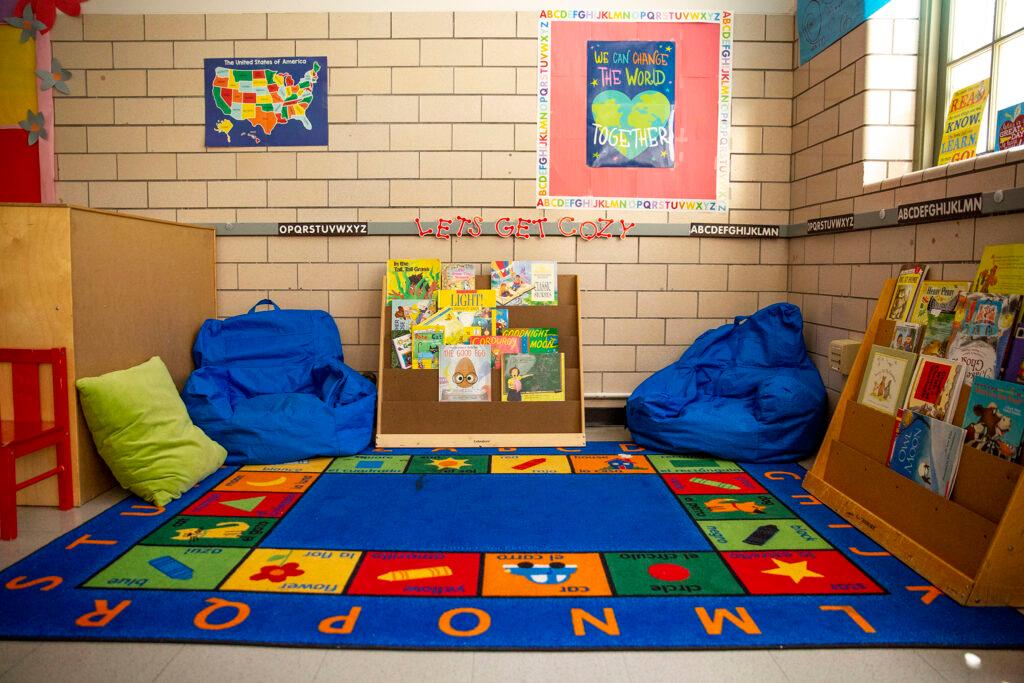

Impacts to K-12

1. Private-school voucher plan

What the bill does: Sets up a $20 billion program to create a national private school voucher program.

It would provide federal tax credits for donations to private organizations that grant scholarships. Taxpayers could contribute the greater of $5,000 or 10 percent of their income to the organization instead of paying that amount in federal taxes. The organizations would award scholarships to families with income up to 300 percent of their area’s median income.

Families could use the scholarships at private schools, religious schools, homeschools as well as for online education.

Supporters say vouchers open up opportunities for children, while critics say they draw funds from public schools and benefit the wealthy whose children are already enrolled in private schools.

Though Colorado voters have rejected school vouchers several times, the plan would apply in all 50 states.

2. Cuts to SNAP and Medicaid

What the bill does: Cuts $793 billion over 10 years to Medicaid and $267 million from SNAP.

The bill would take away food assistance from people with children over the age of 6 who aren’t working at least 20 hours a week. One estimate shows about 188,000 Colorado adults and their children at risk of losing all or some SNAP benefits. Food insecurity impacts attendance, concentration and academic performance.

The cuts could harm schools in Colorado. In the 2021-22 school year, $70 million in Medicaid dollars paid for 925 school nurses and psychologists, health related equipment and supplies and mental, social and emotional health support.

Impacts to higher education

3. Pell Grants for low-income students

What the bill does: Raises the threshold for full-time enrollment from 24 to 30 credit hours per year or 12 to 15 credit hours per semester. Eliminates Pell Grants for students attending less than half-time, or 15 credits per year. Expands Pell eligibility to short-term programs 8 to 15 weeks long.

Potentially thousands fewer students of Colorado’s 70,000 currently receiving Pell Grants (23,000 at community college) would be eligible under this change.

Nationally, only about 36 percent of undergraduate Pell Grant recipients currently take 30 or more credits per year. Two-thirds would either lose or see their Pell grant amount reduced. Maximum Pell grants would be slashed by $1,685.

Critics say the new rules would force some students to either take on more debt or more hours of course work. Higher education leaders worry working students and student parents will leave college. One estimate places more than 55,000 Colorado students at risk of losing some or all of Pell funding.

Proponents say there’s less money for Pell because the program this year is expected to have a $2.7 billion deficit and reserves will soon run dry. The administration also blames fraud for funding shortfalls.

4. Student loans overall

What the bill does: Eliminates subsidized loans for undergraduates and Grad PLUS loans for graduate students. Establishes new borrowing caps: $50,000 for undergraduates, $100,000 for graduate students, and $150,000 for professional students. Lifetime student loan caps of $200,000. Alters Parent PLUS loans by requiring students to borrow maximum allowable amounts before parent loans; caps Parent PLUS at $50,000.

Colorado has about 782,000 student loan borrowers. Critics say eliminating subsidized loans, which don’t accrue interest while the borrower is in school, will drive up borrowing costs for students. Other critics worry the cap on loans could worsen the doctor shortage. Republicans say the current system is “effectively broken and littered with incentives that push tuition prices upward.”

5. Loan repayment reforms

What the bill does: Cancels Biden administration’s SAVE plan for new borrowers and about a dozen other income-driven repayment plans. Creates two ways to repay student debt: a Standard Plan (fixed payments over 10 to 25 years) and a Repayment Assistance Plan (RAP) tied to one’s adjusted gross income with no loan forgiveness until 30 years of payments. Eliminates protections for borrowers making less than $10,000 a year.

More than 134,000 Colorado borrowers are in the SAVE program, but it's currently tied up in the courts. Critics say the new RAP program could mean higher payments for some borrowers. They say borrowers in previous plans could get forgiveness after 20 or 25 years, while the new plan extends it to 30. Proponents say streamlining the “maze” of current programs is needed and say while loan payments are higher for borrowers, taxpayers will save money. A Senate version of the plan nearly identical to the House’s came out Tuesday night, though it would not eliminate Pell for part-time students and walks back the risk-sharing proposal (below.)

6. College accountability measures

What the bill does: Requires institutions to pay a fee for graduate’s unpaid loans.

Proponents say it would incentivize colleges to keep costs down and make sure students get jobs upon graduation. Critics say it disincentivizes colleges to serve underrepresented, high needs students who struggle the most in the labor market. The American Council on Education last year found Colorado’s four-year colleges alone would face a $784,000 penalty.

7. Regulatory rollbacks

What the bill does: Repeals a rule that helps cancel loans for federal student loan borrowers for attending for-profit schools that engaged in fraudulent or misleading behavior. Eliminates a rule that provides protection for students from career training programs that leave them with high levels of debate and low earnings.

Colorado has about 39,000 borrowers waiting for relief from the first rule, the borrower discharge rule. No statewide data is available for the second rule called gainful employment.

8. Medicaid cuts

What the bill does: Cuts $793 billion over 10 years to Medicaid.

Thousands of low-income Colorado college students would lose their health insurance coverage. Republicans say cuts are needed to eliminate waste and abuse and some say the current matching system incentivizes states to expand Medicaid.

9. SNAP cuts

What the bill does: Cuts the food stamp nutrition program by $300 billion over 10 years

Thousands of college students facing food insecurity could also lose access to SNAP food programs. One recent study shows that 12 percent of Colorado community college students participate in SNAP and 5 percent of four-year students participate. Far more students are actually eligible to participate.