Xcel Energy and three Colorado agencies are seeking to fast-track several clean energy projects next year to qualify for expiring federal tax credits, according to a proposal filed last week with state utility regulators.

The proposal is an opening salvo by the Polis administration to expedite clean energy development as the second Trump administration slashes federal support for zero-carbon energy sources and prioritizes fossil fuels.

Requests to build new power projects must be approved by the Public Utilities Commission (PUC), whose members are appointed by the governor but who operate independently.

That approval and construction process can take years, and Xcel already has several sprawling plans under consideration to add clean power to the grid. The latest proposal attempts to expedite a small number of projects to take advantage of credits before they expire. But there is no guarantee that regulators will approve the plan, or that the projects will be financed and built.

The proposal is a blunt acknowledgment that the Trump administration is rapidly raising costs to build wind and solar projects, which are generally cheaper and faster to build than adding new fossil fuel plants to the grid.

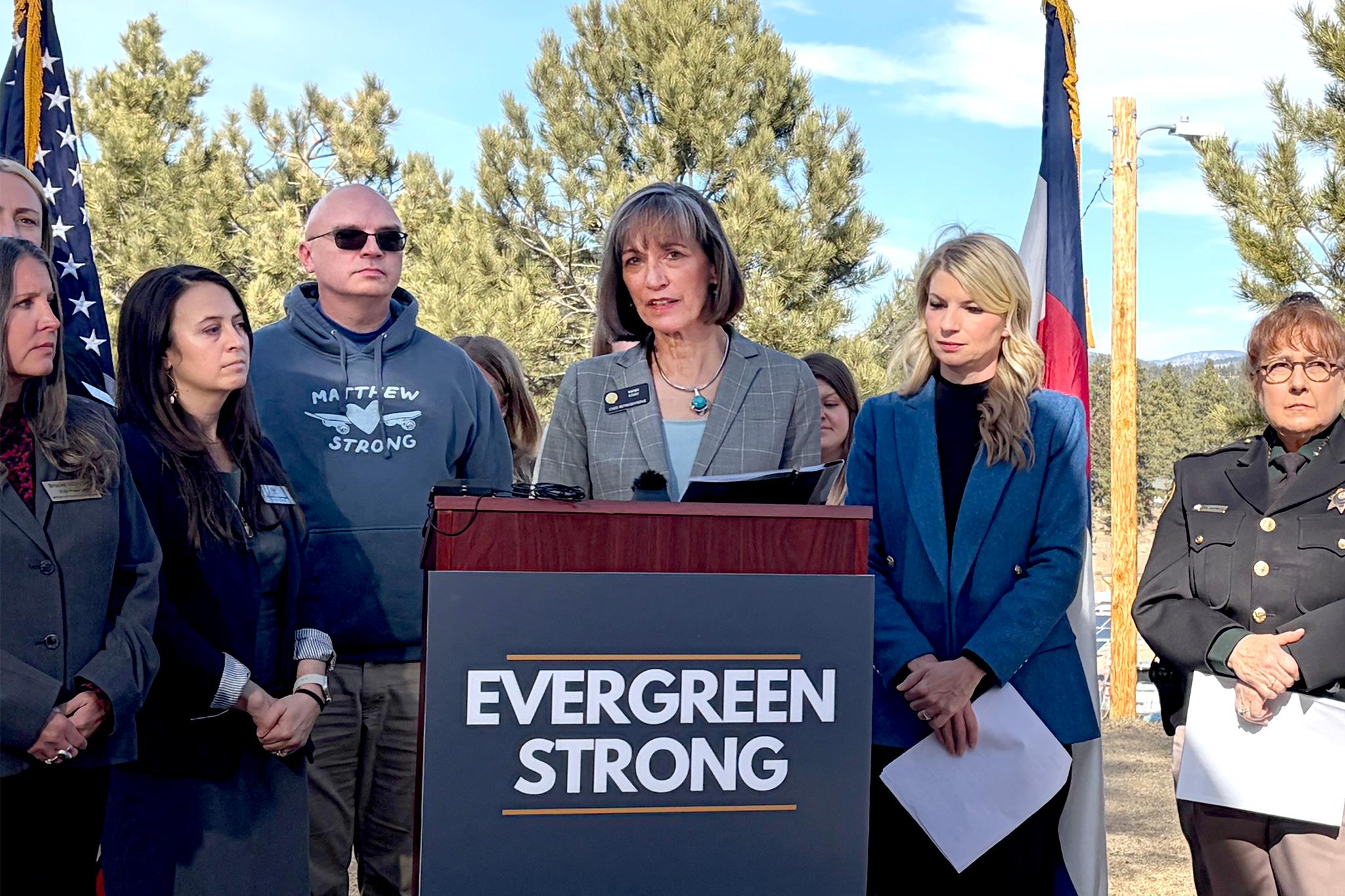

“Based on the analysis that we’ve seen, we believe that wind and solar will continue to be the lowest cost new generation available on the grid,” said Will Toor, head of Colorado’s Energy Office.

“But that lowest cost energy will be more expensive than it otherwise would be, significantly more expensive, due to the expiration of those tax credits,” he added.

The proposal, known as a “Near-term Procurement,” aims to quickly greenlight the construction of up to 4,000 megawatts of projects that use a mix of wind, solar and battery storage. That’s enough electricity to power hundreds of thousands of homes every year, but a far cry from the amount of new electricity Xcel estimates it’ll need over the next decade.

It also seeks approval to generate a smaller amount of electricity from fossil fuel sources like natural gas.

The Colorado energy office, Xcel Energy, staff at the PUC, and the state’s Office of the Utility Consumer Advocate filed the proposal to regulators.

In a letter to state agencies in August, the governor said the state would remove barriers to building new projects.

“We will work to ensure qualifying, cost-effective energy generation starts construction or is placed in service in time to receive federal tax credits,” Polis wrote.

Expiring federal credits

In July, President Trump signed H.R.1, also known as the One Big Beautiful Bill Act, which eliminates tax credits for wind and solar projects by December 2027.

Earlier this month, the U.S. Treasury Department released new guidance for how such projects could qualify for the expiring credits. New wind and solar projects must start construction by July 2026 or be fully completed by December 2027 to access the credits.

Those deadlines mean Colorado, clean energy developers and Xcel Energy are racing to break ground on projects, to take advantage of billions of dollars in credits before they vanish.

Without credits to help finance projects, Coloradans are likely to be saddled with higher energy bills in the future, according to Joseph Pereira, deputy director of Colorado’s Office of the Utility Consumer Advocate.

“There is money on the table to save ratepayers on their bills,” Pereira said. “But the timeline on those credits is very short, and so it requires action now.”

Xcel counting on renewables as U.S. electricity demand soars

In early September, state utility regulators will decide whether the proposal’s timeline and framework to approve projects can move forward.

If the proposal moves forward, Xcel would then collect bids from clean-energy project developers by early October and spend several months reviewing them. Regulators will weigh in by February 2026 with a final decision to approve or deny selected projects.

If regulators approve the proposal in February, Xcel can then finalize contracts so projects can begin construction and qualify for the credits, according to Pereira.

Xcel is depending on renewable energy to meet state-mandated climate goals and keep up with electricity demand from data centers, electric vehicles, heat pumps and more.

It has submitted a bevy of plans to state regulators since 2021 to build new projects, which will collectively cost more than $20 billion. Most of those costs will be billed back to Colorado customers in the form of higher energy bills.

To offset the costs of building those projects, Xcel was counting on billions of dollars in tax credits and federal incentives from the 2022 Inflation Reduction Act, President Biden’s landmark climate law. That law streamlined several tax credits for wind, solar and other clean-energy projects.

But the Trump administration’s push to axe the credits will now leave wind and solar energy without a critical source of funding, at a time when demand for electricity is surging.

“We’re at a moment when we need to be accelerating resources that we bring to the grid,” Toor said. “But the federal government instead is doing everything they can to slow down the ability to bring new generation online and to increase the cost of that generation.”

Electricity bills have also increased faster than the inflation rate over the past year, despite President Trump’s campaign promise to cut bills in half during his first 18 months in office.

The proposal is among a handful of efforts nationwide to fast-track renewable projects after the passage of the One Big Beautiful Bill Act. In July, Maine utility regulators gave project developers just two weeks to submit proposals that could capitalize on the expiring tax credits.