This article is part of our look at potential refunds from the Taxpayer's Bill of Rights. Learn more about how TABOR works here.

Title: HB15-1234 Income Tax Deduction For Leasing Out an Agriculture Asset

Sponsors: Rep. Diane Mitsch Bush (D-Steamboat Springs), Sen. Jerry Sonnenberg (R-Sterling)

Status: Introduced and assigned to the House Agriculture, Livestock, & Natural Resources and Finance committees on Feb. 19. The Agriculture, Livestock, & Natural Resources Committee referred an amended version of the bill to the Finance Committee on March 9. The Finance Committee referred an amended version of the bill to the Appropriations Committee on April 1. The Appropriations Committee referred the bill to the whole House on April 17. The House passed its third reading of the bill on April 21 and introduced it to the Senate finance and appropriations committees. The Senate Finance Committee killed the bill on April 28.

What the bill would have done: The bill creates an income tax deduction for taxpayers who lease certain agricultural assets to an eligible beginning farmer or rancher. The deduction is worth 20 percent of the lease payments received from the eligible farmer or rancher. However, the deduction only lasts three years.

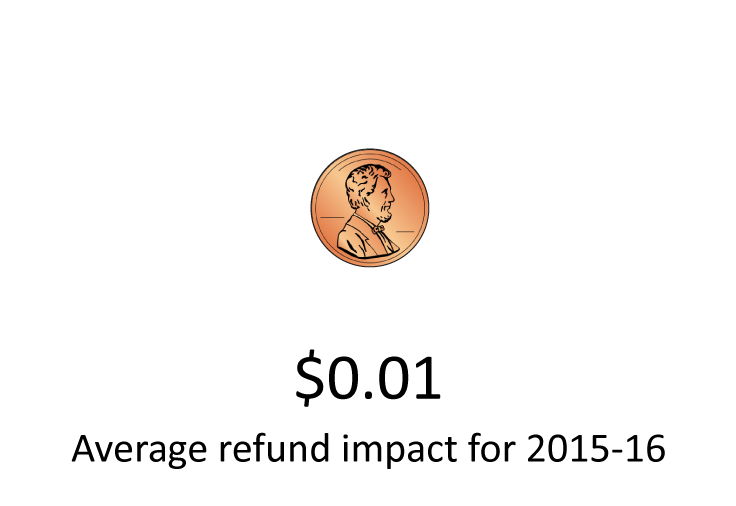

How it would have affected your refund: This bill would lessen the average taxpayer refund by one cent in the fiscal year 2015-16.