This article is part of our look at potential refunds from the Taxpayer's Bill of Rights. Learn more about how TABOR works here.

Title: HB15-1383 Modifications Low-income Housing Tax Credit

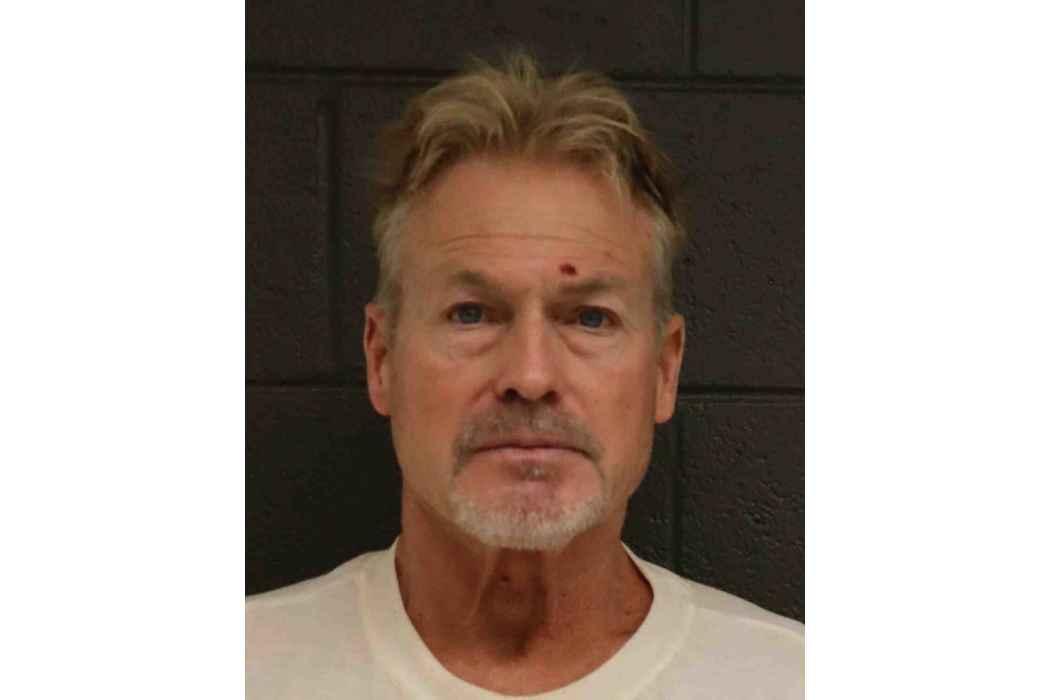

Sponsors: Rep. Max Tyler (D-Lakewood), Rep. K.C. Becker (D-Boulder)

Status: Introduced and assigned to the state House State, Veterans, and Military Affairs Committee on April 24. The State, Veterans, and Military Affairs Committee referred the bill to the Finance Committee on April 29.

What the bill would have done: The bill would have changed Colorado's low-income housing credit to allow the Colorado housing and finance authority to issue the credit for three additional years. The bill would also add provisions to allow this to happen.

How it would have affected your refund: This bill would not reduce the average taxpayer refund until fiscal year 2016-17; CPR is measuring fiscal year 2015-16.

What's being said about the bill:

Joey Bunch, writing for the Denver Post on April 30:

With the session rapidly drawing to an end and the reality of the bills’ near-certain death in the Senate, Democrats will have to decide how much time they can afford to spend on House Bill 1384, House Bill 1383 and House Bill 1385, respectively.