Ashley Stoddard’s frustrating search to buy a home left her putting in offer after offer for over a year.

“I kept getting beat out by cash,” she said. “Like, people would just put down $300,000, $400,000 in cash. I don’t have that.”

Her story isn’t unusual, especially since she wanted a home in Boulder, an even more difficult market than the rest of the Front Range. The freelance video game artist wanted to know who was filling all the housing in one of the state’s expensive, hyper-competitive markets, so she asked Colorado Wonders if it was something we knew more about.

In Stoddard’s circle of friends, “outside of the one guy who works at Google,” homeownership is a rarity. Colorado’s homeownership has fallen from 71.2 percent in 2005 to 65.1 percent in 2019, according to the U.S. Census Bureau.

“Unless you’re a software developer, engineer — and there are a fair amount of those — but outside of that, I was like, ‘who else is here, what are they doing?’” Stoddard wondered.

Colorado Has Been Here Before

The Centennial State is a desirable place to live and people have flocked here for decades. The influx puts pressure on a market that just can’t keep up. News articles that bemoan this state of affairs can be found stretching back a half a century. Many longtime experts agree though that it’s worse now and there’s still no good solution.

So, where do the people come from today?

California, Florida, Texas, New York and Illinois, according to Elizabeth Garner, the state demographer.

She said the state, especially the Denver area, continues to add millennials in droves, otherwise known as people who are in their early 20s to late 30s. In the past, population growth was spread across the state, but it’s more concentrated along the northern Front Range now, from Denver to Fort Collins, Garner said. Add on top of that the migration from rural corners of the state into Denver as well.

Part of the problem, when it comes to housing, is Colorado’s population is also aging and empty nesters want to downsize.

“They want a smaller single family home, then you got the millennials that want to get in, they want a smaller single family home,” Garner said. “And so you’ve got two huge generations going after the same product.”

Homebuilders lag way behind in constructing new places to live. In 2018, companies received permits to construct 29,114 single family detached homes, 38 percent lower than the 40,140 permits in 2005. But back then, there was 1 million fewer people in Colorado.

About That California ‘Issue’

Some Colorado transplants come from relatively low-cost housing states like Texas or Florida. Others come from high-cost markets, like California or D.C and “they’re coming with the ability to buy cash,” said Justin Knoll, a longtime real estate agent in Denver.

“They’re buying half-million dollar homes with cash. That is not necessarily because they made a ton of money or are super rich or anything, it’s just because the vehicle they used in California in real estate paid off tremendously.”

Median single family home prices in the California Bay Area, for instance, are nearly double Denver’s average: $935,000 in the bay versus $465,500. Knoll admits that puts locals at a tremendous disadvantage.

Home prices have risen in Denver much faster than incomes. The S&P Case Shiller home price index shows home values are up 46 percent in the metro in the last five years, and average hourly wages are up 16 percent in that same time, according to the state labor department.

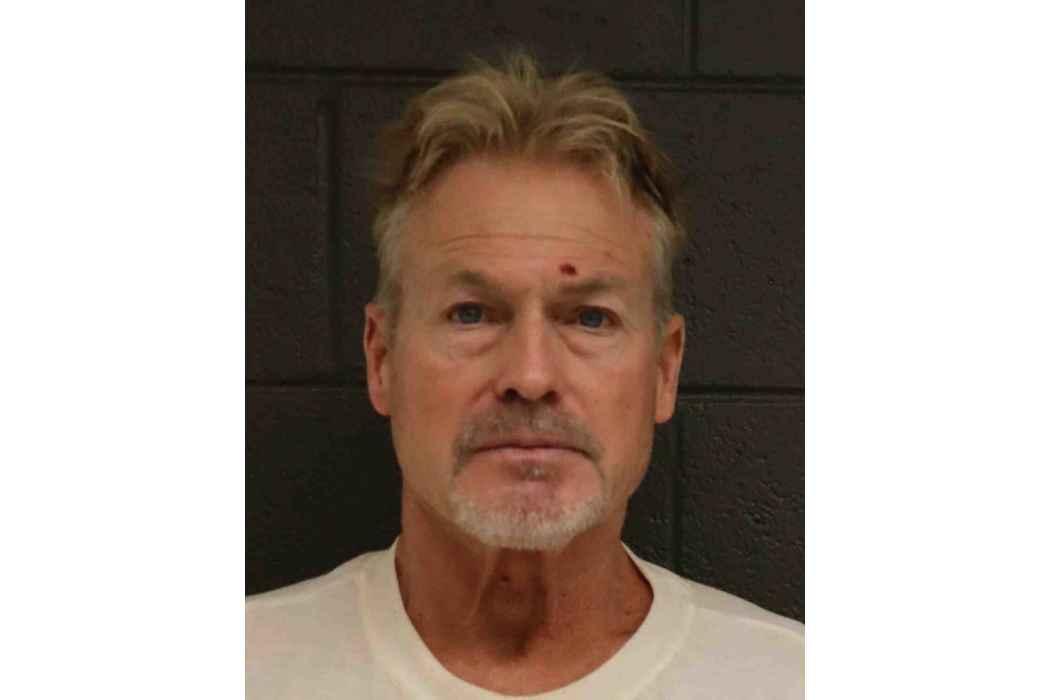

Brad Nelson kind of sees both sides of it. The Wisconsin native lived in Colorado before he took a job in California. The hotel chain manager has also recently moved back to Colorado. He was renting a small apartment south of San Francisco.

“The prices out there are outrageous,” Nelson said. “We had a 600 square foot loft. So, not even like a bedroom, we didn’t have a bedroom door, and it was like over $3,000 a month.”

Nelson rented out his Denver home while he was in California. He and his wife had planned to sell it and put a down payment on a home in the Bay Area, taking advantage of how much his Denver home had appreciated.

“Which we thought was like, ‘that was great,’” Nelson said. But they “couldn’t get anything in San Francisco within an hour and a half of the city.”

They came back to Denver and Nelson even took a pay cut to move, because the city is such a popular location within his company.

That brings us back to Ashley Stoddard, who wondered who was filling up all real estate in Colorado. Here’s the twist. She only needed to look into the mirror as she came here from California after getting priced out of Los Angeles. She eventually found a Boulder condo and admits she’s actually part of the reason housing is more expensive here.

“Oh yeah, I understand that,” Stoddard said. “But also my income is not advancing in such a way that I will ever get out from under paying 50 percent of my income for a mortgage.”

Her father advises that she shouldn’t pay more than 25 percent of her income on housing. But Stoddard just laughs when he says this because really, there’s no choice.

Are you curious about something in the Centennial State? Ask us a question via Colorado Wonders and we’ll try to find the answer.