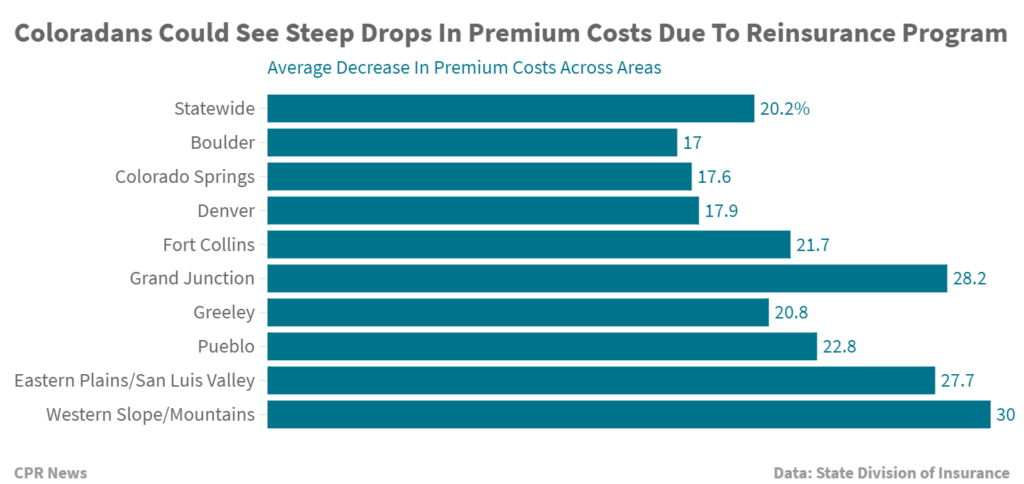

Colorado consumers shopping for an individual health insurance plan will see an "unprecedented" drop in premiums — an average statewide decrease of 20.2 percent.

Gov. Jared Polis and other top state officials made that announcement Thursday at the Capitol. The governor said many families could save thousands of dollars a year.

Those who buy individual plans make up about 7-8 percent of the health insurance market.

“But lowering rates for people with individual insurance plans also helps bring down rates for everyone,” Polis said.

He said the lower rates should encourage more people to buy coverage, which will reduce the number of uninsured people who go to hospitals to get uncompensated care. Those costs get passed along to others, even those who get insurance through their workplace.

“So when more people are covered, providers don’t pass on the cost of uncompensated care in the form of higher premiums to others,” Polis said.

State Sen. Bob Rankin, a Republican from Carbondale, credits a new bipartisan reinsurance program.

"I hope that this is a start,” Rankin said. “I hope that this gets more people insured, gets more people access to healthcare, but at the same time, we have to be very aggressive to continue the efforts."

Colorado got approval for the reinsurance proposal in July. Other states, like Alaska and Maine, have implemented similar programs and saw double digit drops in premium costs.

“We made monumental progress,” with the rate reductions, Lt. Gov. Dianne Primavera said. She said the changes will have “real life” implications.

“This is thousands of dollars for a family of four in Durango who can now afford new bikes for their kids,” Primavera said.

“These decreases translate into real savings for Coloradans,” Colorado Insurance Commissioner Michael Conway said. He also noted the price decreases would allow for more access to health care.

Rural Coloradans should see the biggest drops, according to the state's Division of Insurance. Residents living in the Eastern Plains and San Luis Valley can expect a nearly 28 percent decline in premiums on the individual market. For those on the Western Slope and mountain areas, the drop should be even higher, reaching 30 percent.

“This is big news,” Democratic state Rep. Julie McCluskie of Dillon said. “Health insurance rates sold on the individual market will be falling dramatically, and the typical family of four living in the mountains and some rural areas of our state will see a savings of over $10,000 next year.”

Katherine Mulready, senior vice president and chief strategy officer with the Colorado Hospital Association, agreed that the program could be a game changer. Hospitals would be contributing about a third of the state’s share of the cost of the reinsurance program, Mulready said.

“We have a lot of skin in the game on this, and we’re happy to see the first results of its success,” she said.

Insurers also praised the rate decreases.

“We are pleased that health plans’ efforts to achieve stability and greater affordability on the individual market are beginning to pay off for Colorado consumers,” said Amanda Massey, executive director of the Colorado Association of Health Plans. “We support innovative, market-based solutions that help to address the high prices of health care that drive premium costs.”

Both the governor and Conway said they believe the savings are sustainable and will continue in future years.

“We view this as a short to medium term program, pending federal changes,” Polis said. “There’s so much in flux at the federal level, it really needs to be reexamined if there’s a different president or a different healthcare plan.”

Even with the new premium reductions, the state’s exchange, Connect for Health Colorado, is encouraging consumers on the individual market to shop around to take advantage of the savings. It said 77 percent of current customers qualify for tax credits to help them pay for insurance.

Eight health insurance companies will offer 130 plans through the state’s marketplace, including a new carrier, Oscar Health. Peak Health Alliance, a new cooperative which helped bring down Summit County’s premiums by 34 percent, will also offer plans through the exchange to residents of Summit County via Bright Health.

Open enrollment runs from Nov. 1 to Jan. 15, 2020. Consumers must enroll by December 15 to have coverage in place by Jan. 1, 2020.