A coalition of education groups has filed four ballot initiatives with the state that would channel millions of dollars to public schools without raising taxes. The money could help school districts attract, retain and compensate teachers.

Next, the Title Board must approve the title of any proposed ballot measure. Then, once approved, initiative backers must choose one of the four before they can begin collecting the nearly 125,000 signatures needed to get on the November ballot.

The proposals come as the state faces a critical teacher shortage with widespread fears among districts that many more teachers may resign at the end of the school year.

The Great Schools Thriving Communities Coalition wants to use some of the excess state revenue that is supposed to go back to taxpayers under Colorado’s Taxpayer Bill of Rights. Residents are issued refunds when tax revenues surpass the TABOR spending cap limit. The initiatives call for allocating at least an additional 0.33 percent of income tax revenue into the State Education Fund.

It’s estimated the state may refund about $4.7 billion to taxpayers between now and 2025.

The initiatives would ask Colorado voters for permission to unlock some of those state revenues for public schools. Backers stress that the measure wouldn’t take all the refunds.

“Right now, because of the combination of a hot economy and formulas in the Colorado constitution, the state is collecting almost $2 billion more than the legislature is allowed to spend on underfunded services like public education this year,” said D.J. Anderson, a Poudre School District parent and school board member and one of the initiative’s two proponents. “Only we the voters can unlock those funds so that teachers can afford to live where they teach.”

Backers estimate that even if the measure passed, there would still be $1.2 billion in refunds for taxpayers this year.

Under the proposed measures, local school districts would be able to use these newly available funds to address chronic shortages in teachers and student support professionals that have only worsened as a result of the COVID pandemic, the coalition said.

The measures would redirect an estimated $820 million to $1.1 billion annually to the State Education Fund, where it must be used to supplement current education spending.

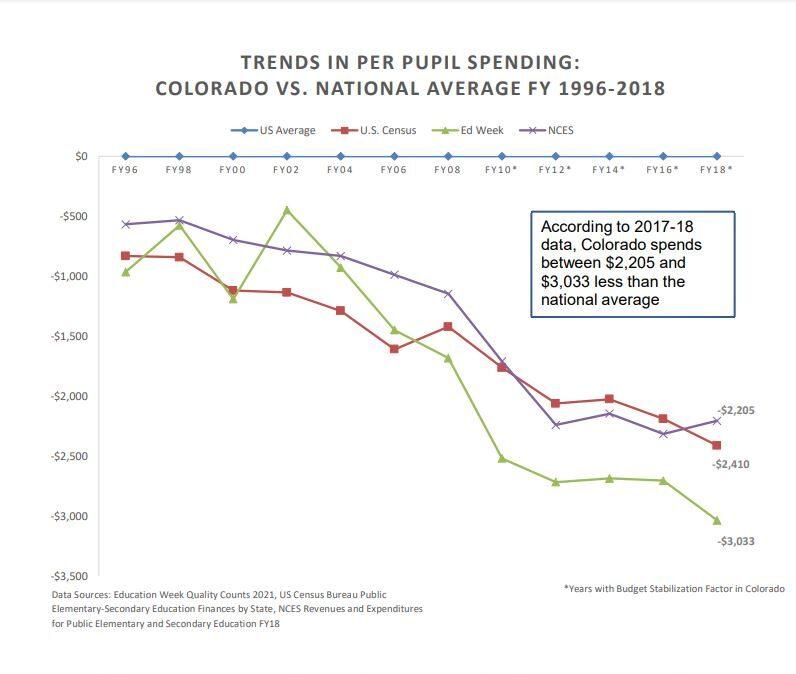

Backers argue that Colorado is funding schools far below what they are supposed to be under the constitution. Though the state’s constitution ties school spending to the rate of population growth plus inflation, each year lawmakers withhold millions of dollars from public schools in order to balance the state budget. This year it was $572 million and has totaled more than $10 billion since the 2009-10 school year.

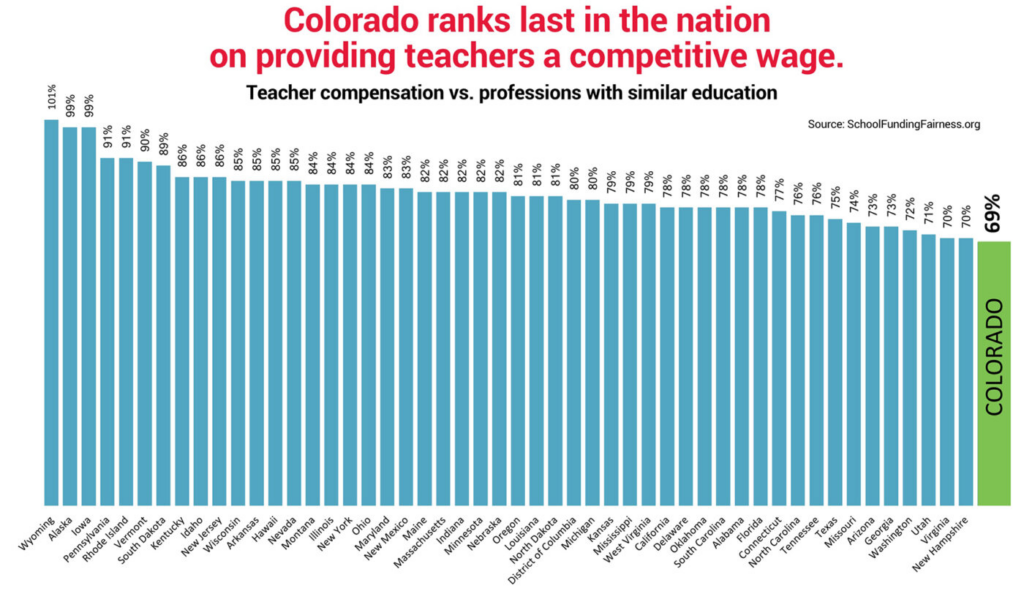

Colorado currently spends $3,000 less per student than the national average. It also has the least competitive teacher salaries in the country, according to Tracie Rainey, executive director of the Colorado School Finance Project.

Rainey said if voters approve a change, it would allow the legislature to begin making changes to how schools are funded — something that has eluded lawmakers for more than a decade. That includes putting more money into serving students with disabilities, gifted students and students living in poverty, as well as evening out inequity between school districts.

“This would actually give an opportunity to have some of those discussions,” Rainey said.

Voters have rejected several statewide attempts to raise money for public education. Rainey said the large amount of revenue projected to be coming into state coffers the next few years allowed a new strategy this year.

“You’re able to do it without raising taxes, not putting a burden on other services,” she said.