The number of Coloradans who have health insurance has reached a historic high, according to a new survey from the non-profit, non-partisan Colorado Health Institute.

When Obamacare launched two years ago, about one in seven of the state's residents, or 14 percent, were uninsured. Now that figure is 6.7 percent.

Marilyn Kruse, a substitute teacher in the Jefferson County school district, is one of those who got insurance after the Affordable Care Act launched.

For seven years before that, she went without insurance because she couldn't get it through her job. Some companies denied her coverage because she had pre-existing medical conditions. Others wanted to charge her more than she could afford.

All the while, she continued to have health problems: a hip that needed surgery, carpal tunnel, bunions and a slipped disc.

"I had the disc go out and I was confused and scared," Kruse said.

She was scared that she couldn't pay to treat or repair her back problems. So she mostly avoided going to the doctor. When she did, she paid thousands of dollars out of pocket.

Then health reform launched. Kruse qualified for tax credits through Colorado's health insurance exchange, so she could buy a plan with Kaiser. Her premium: $55 a month.

"That was a very exciting moment in my life," Kruse said. "I didn't realize how important it is to have good insurance that you can afford."

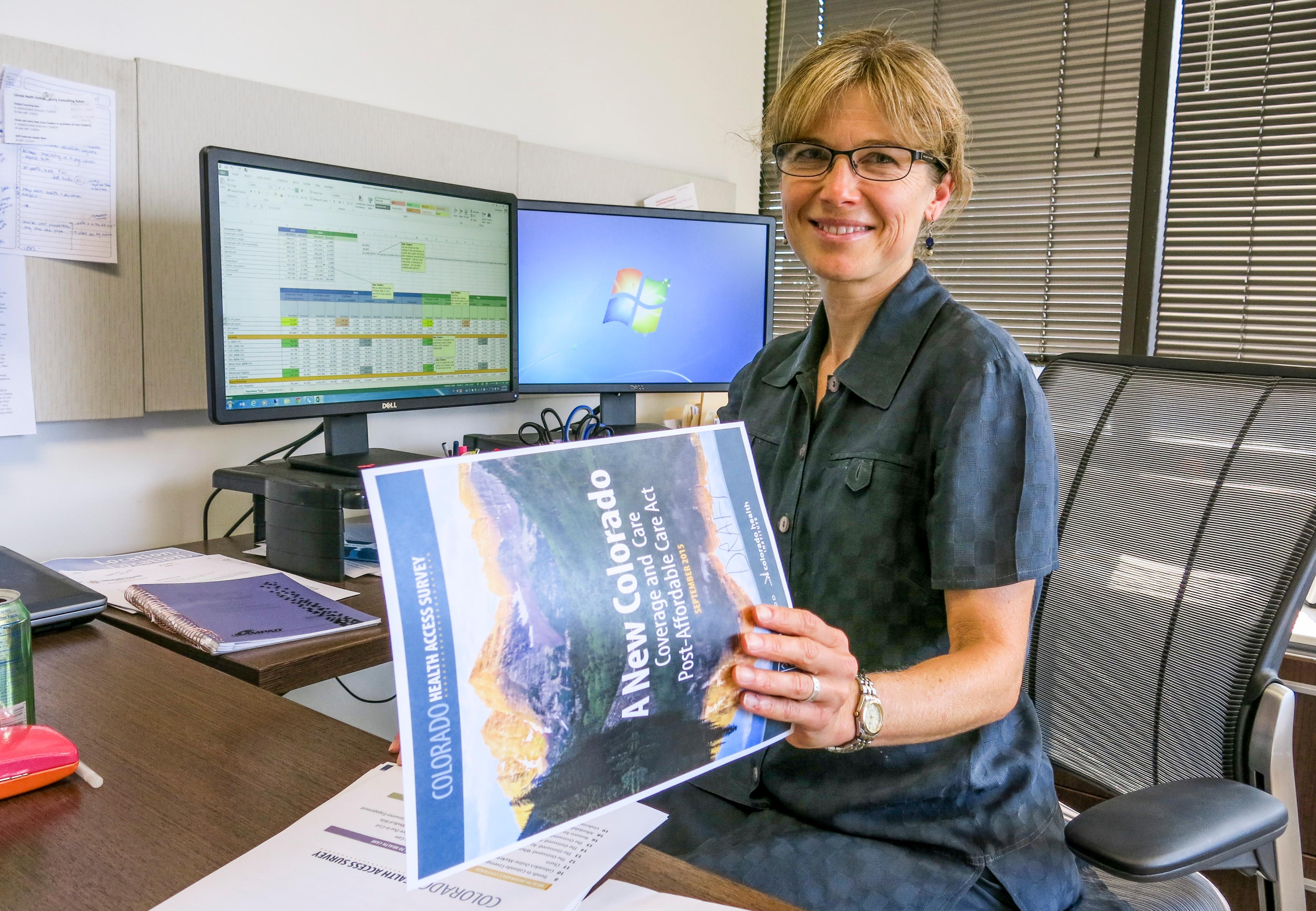

CHI's new report documents just how many of the state's residents have similar stories. Their 2015 Colorado Health Access Survey provides the first comprehensive analysis of the impact of the Affordable Care Act.

The Institute's Amy Downs says all signs pointed to a solid decline in the uninsured rate, but that it dropped so sharply, to mid-single digits, was a big surprise.

"I don't think that anyone was expecting it to really go down this much," Downs said.

The drop, she says, is record breaking. In 2013, nearly 750,000 Coloradans were uninsured. Obamacare cut those numbers in half, to a level that was once considered unreachable, says Downs.

"We see a big growth in our Medicaid population that is much higher than we expected as well," she said.

Under the ACA, the decision to expand Medicaid, the health plan for low-income Americans, was left up to the states. Colorado decided to expand.

That's led the state to enroll about 450,000 people in the last two years. One in five residents is now on Medicaid.

"Getting everyone covered was our first priority," says Susan Birch, Executive Director of the agency that administers Medicaid in Colorado, the Department of Health Care Policy and Financing. "Now we turn our focus to improving the health of those we serve."

Underinsured Coloradans Still Have Trouble Getting Care

But, Downs says, the expansion in health coverage is tempered by rising concerns over cost, and the rate of people who are underinsured.

"The increase in the underinsured really stood out for us," Downs said.

If you have insurance, but your out-of-pocket health care costs are more than you can afford, then you're considered underinsured. An unaffordable out-of-pocket cost is defined in the survey as more than 10 percent or more of their annual income. For those at 200 percent of the federal poverty level, any cost above five percent of income is considered unaffordable.

Downs says the number of underinsured Medicaid enrollees alone grew by more than a 100,000 people since 2013. "People on Medicaid have really low incomes, so it doesn't take very much spending to get them into that underinsured category," said Downs.

Gwendolyn Funk, a 37-year-old, who lives in Dove Creek in the southwest corner of Colorado considers herself underinsured. "Well, I'm glad that I have insurance, it's just that I can barely afford my policy and my premiums, along with my children's," said Funk.

Funk's husband, a mechanical engineer, gets insurance through his employer. But it's too expensive for her and their two kids to get insurance through him because they don't qualify for tax credits. So they pay $500 a month to privately insure Funk and the children.

"We're going to have to choose between basically either eating or paying for health insurance," Funk said. "It's going to be really, really difficult."

That predicament caught her husband's cousin Heather Nielson too. She's 30 and her son is 2.5 years old. Her husband gets insurance through his job as a truck driver. But buying insurance through his policy is too expensive. Like Funk's family, she says because of the way the law is worded, a federal formula used to calculate who is eligible for tax assistance puts her family's income above a key benchmark. As a result, they don't qualify for tax credits or Medicaid.

"It is stressful," Nielson said.

She and her child are currently uninsured. It's tough because she's been battling bladder cancer and her son came down with German measles. Now her health costs are mounting. So is her debt, which has spiraled to $50,000.

Big Uninsured Drops Reach Some, Not All

There were predictions that a sharp uptick in coverage would overburden the system, making it harder for people to get health care. So far that hasn't happened. The survey found only a slight increase in the percentage of people who couldn't get an appointment when they needed.

Also, the report documents glaring disparities. Hispanics are uninsured at higher levels than other groups, while higher uninsured rates continue to affect residents of the Western Slope.

Back at her home in Wheat Ridge, Marilyn Kruse shows off her garden. It's chock full of ripening vegetables, tomatoes, onions, and a very large sunflower.

It must be 14 feet tall. The towering, flowering plant is a nice surprise for Kruse, who recently qualified for Medicare when she turned 65.

She says things have been easier since she was able to get insurance through Colorado's exchange. She calls the ACA, that made the changes possible, a "really great thing and I hope it's around for a long time to come."

The next frontier, health advocates say, is to get even more people the care they need, that's affordable too.

Editor's Note: We originally reported that Funk's family didn't quality for tax credits because her husband's income exceeded a certain level. It is true the family doesn't qualify for tax credits. We're refining our explanation of that a bit further. The ACA determines whether employer-based coverage is affordable based only on the cost of covering the worker, which doesn't take the cost of family coverage into account.