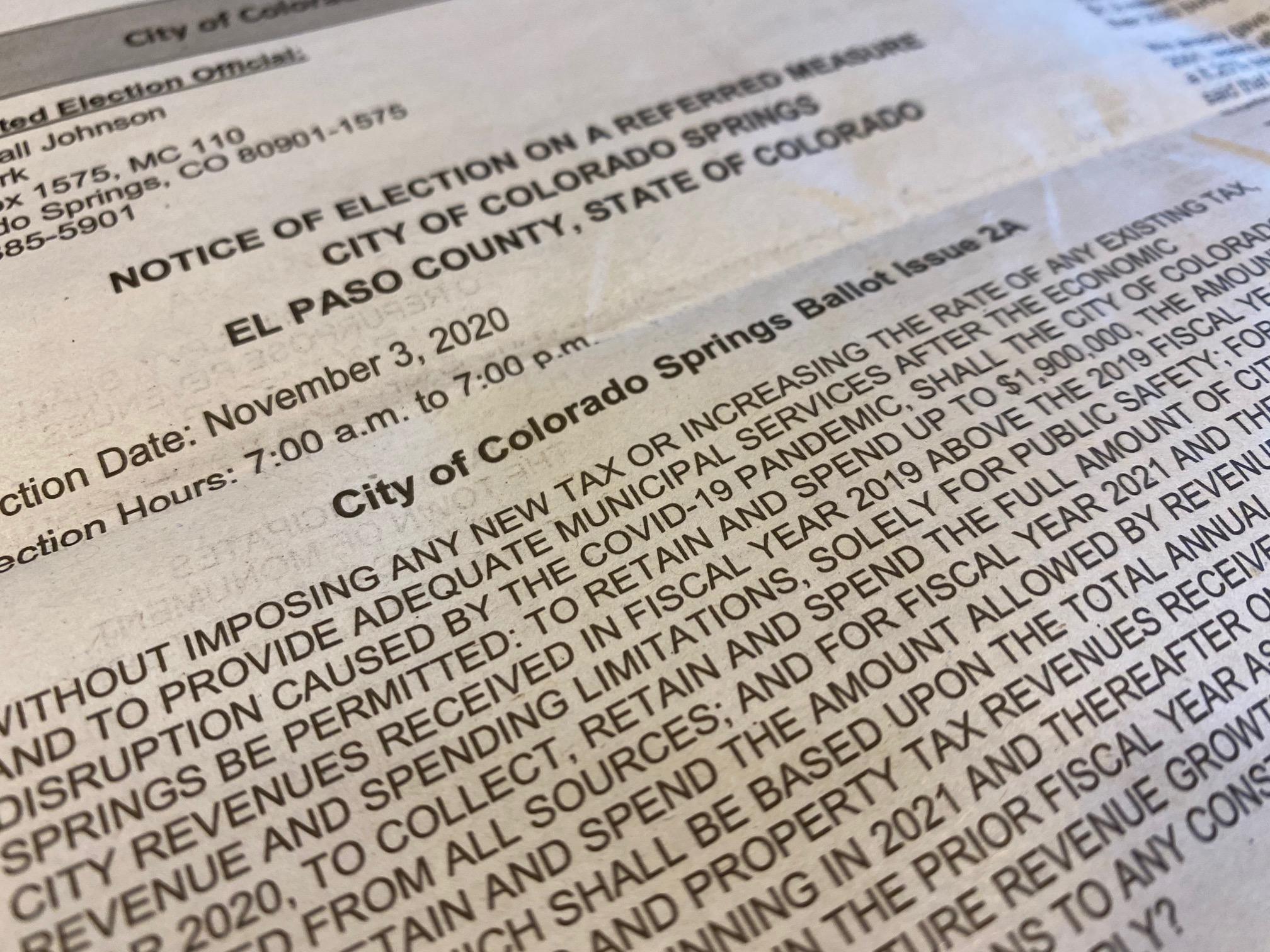

This initiative asks voters three things:

- To allow the city of Colorado Springs to retain money that would otherwise be refunded under the Colorado Taxpayer's Bill of Rights. The money would go toward public safety, although the exact use is unspecified;

- If the city can collect and retain the full amount of city revenues in fiscal year 2020;

- If the city can base next year's spending limitations on 2019 revenue levels.

Simply put, this measure aims to keep the local economy operating at 2019 levels in order to help Colorado Springs recover from the economic crisis brought on by the COVID-19 pandemic. The initiative would exempt the city from “ratcheting down” its tax revenue base. The exemption would not be permanent, though.

If voters decide to let the city keep the money that would otherwise be refunded, Colorado Springs will retain $1.9 million to be used for public safety. The refund translates to about $7 per household, according to Dr. Tatiana Bailey, Director of the University of Colorado Colorado Springs Economic Forum in the College of Business. For a four-person household, that's a refund of $1.50 per person.

"The city can use that $1.9 million to help ensure that we get back to pre-COVID economic growth," Bailey said. "That money has been gathered through sales and use tax because consumers are actively buying and businesses are actively buying. And why are they doing that? Because of good economic times."

Bailey said the key points of Issue 2A are that it's not a tax increase and it aims to prevent local and state government from having to provide the increased unemployment benefits, Medicaid payments, food stamps, etc. with a lower tax base brought on by the pandemic.

Those in favor argue this would help Colorado Springs recover from the economic crisis brought on by the COVID-19 pandemic. In his State of the City address, Mayor John Suthers argued that "it could take about three to four years for the city to get back to its 2019 revenue base" if the level is decreased. Suthers said the projected loss in revenue to the city would be at least $20 million.

If voters approve the ballot question, revenue retained by the city in 2021 could be 3 percent higher than 2019 revenue rather than 3 percent higher than 2020 revenues.

Those opposed say changing that base level to the 2019 amount could be problematic and lead to another vote by the public in the future. In an op-ed in the Gazette, Rebecca Marshall, co-founder of SpringsTaxpayers.com, argued that the city would be keeping funds it earned by overtaxing citizens and mismanaging budgets.

More about TABOR

TABOR limits the amount of revenue the State of Colorado can retain and spend. The Colorado Springs has its own additional TABOR in the city charter that applies the same principles to city revenue. The TABOR limit “base” is equal to the lesser of the prior fiscal year’s revenue limit grown by Colorado inflation and population growth, or the current fiscal year's revenue. The growth in tax revenue under TABOR is limited to a percentage that equals inflation plus growth, typically about 3 percent per year.